• First generation to enjoy pension freedoms risk losing years of retirement income

• Past year of volatility to hit drawdown sustainable income payouts by 3.7%

• Consumers should speak to advisers about solutions which combine flexibility with security

Aegon has commissioned research from eValue to establish what is a sustainable level income for someone taking drawdown.

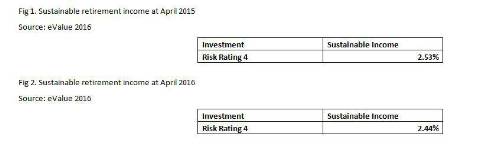

This research shows that for a 65 year old retiree with a £250,000 pot a truly safe level of sustainable income is £6,325 equivalent to an income rate1 of 2.53%.

The first of the ‘Generation Freedom’ retirees taking advantage of the new pension flexibilities in April last year have faced a 12% fall in the FTSE 100 and paltry returns on cash deposits. Someone investing in a fund with a risk rating of 4 (see figure 1), a relatively equal investment mix of bonds, domestic and overseas equities and some property, would have seen their fund value fall by 1.8%2 over the past 12 months.

A 65 year old retiree with a £250,000 pot, advised to take a sustainable retirement income rate[2] of 2.53% per annum at the time, would now have to adjust this down to 2.44%, (see figure 2) or risk running out of money up to two years earlier than expected.

For a pot of this size an annual income of £6,325 would need to fall to £6,092 to have a near certain chance of lasting them 30 years.

People have embraced the pension freedoms and are making the most of increased choice. However, drawdown investors now have to contend with market risk and it’s partly for this reason that ABI figures[3] suggest there’s an ongoing demand for guaranteed income solutions in the face of recent market turbulence. Tapping in to this demand for guaranteed income regardless of market movements, Secure Retirement Income from Aegon provides both a minimum level of guaranteed lifetime income and the chance of investment upside. Based on the same £250,000 investment, had Secure Retirement Income been available it would have given a 65 year old a retirement income of 4.05% in April 2015, locking in £10,125 of annual income that would weather any economic storms, with the benefit of locking in gains if the markets perform well.

Barry Cudmore, Aegon’s guarantee solutions spokesperson, said: “It’s absolutely vital that people have a grasp of the impact that the markets can have on retirees’ income levels and their chances of running out of income later in life. Education is key.

Advisers have a really important role to play in helping people understand their options at retirement whether they choose drawdown or a guaranteed option. For those who want flexibility and to keep their money invested but don’t want to be exposed to the downside risks of market exposure, there are solutions available that lessen the need for constant income adjustments.

“Income solutions that are guaranteed leave people less exposed to market fluctuations and can provide both income guarantees and access to cash when needed. For advisers, this means turning negative conversations about reducing sustainable income levels, into positive conversations about income preservation and even locked in gains.”

Mark Grimes, Product Director at eValue, comments: “This research casts a light on the outcomes for those entering retirement post-pension freedoms. We already know more about what choices retirees are making around their pension pots and retirement income and, with this extra understanding from eValue’s Insight asset model, we now have a realistic view of pension income expectations and returns, as well as the impact that initial market volatility can have on retirees’ financial wellbeing.

“With life expectancies increasing, and the impact of reforms becoming clearer, there has never been a more important time for advisers to have access to the right tools and products to help their clients understand their options and make informed choices.”

|