Key findings:

Average retirement incomes increased by 11% in Q4 2016 and are at their highest since July 2015.

Retirement income has been boosted by strong pension fund returns and sustained annuity upturn.

Annuity competition is intensifying, despite the number of open market annuity providers falling to an all-time low.

Improving annuity rates could provide an incentive for retirees to re-evaluate annuities as an option.

The report assessed the impact of the changing value of personal pension pots and annuity rates on retirement incomes. The figures were based on an individual contributing £100 gross per month into an average personal pension fund over a 20-year period and retiring at the age of 65 with a standard level without guarantee annuity.

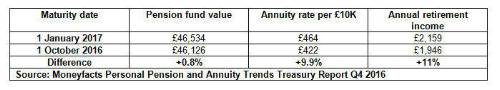

The research shows that someone who had paid £100 gross every month into an average personal pension fund for the preceding 20 years would have built up a pension fund of £46,534 if they retired now, compared with £46,126 if they had retired in October 2016. When the 10% rise in annuity rates over the last quarter is also factored in, this equates to an average annual retirement income of £2,159 today compared with £1,946 at the start of Q4 2016.

Table: Average retirement income October 2016 - January 2017

Pension fund figures as at 1 January 2017 (based on a gross monthly premium of £100) and based on the average of all available pension funds. Source: Lipper. Annuity figures based on a male annuitant aged 65 buying a standard ‘level without guarantee’ annuity. Source: Moneyfacts.

Annuity competition

While higher gilt yields were the dominant influence on the upward direction of annuity rates, the appetite among annuity providers to win new business has also been crucial. There are signs that annuity providers are beginning to price more competitively again and that competition is intensifying after a period of cautious pricing. The greater desire among annuity providers to compete for new annuity business comes despite there now being less choice in terms of open market annuity providers. Seven providers have exited the open annuity market since pension freedoms were announced in March 2014, leaving just eight active providers, an all-time low.

Richard Eagling, Head of Pensions at Moneyfacts, said: For the first time since pension freedoms were introduced, annuity rates have undergone a sustained upturn, rising for four consecutive months – something we have not seen since the period between June and October 2013. The considerable improvement in annuity income during Q4 2016 and the potentially more favourable pricing environment could provide an incentive for retirees to re-evaluate the value offered by annuities. Q4 2016 was a rare period in which both pension fund performance and annuity rates moved upwards, providing a welcome boost to those saving into a personal pension and looking to purchase an annuity.”

|