By Fiona Tait, Technical Director, Intelligent Pensions

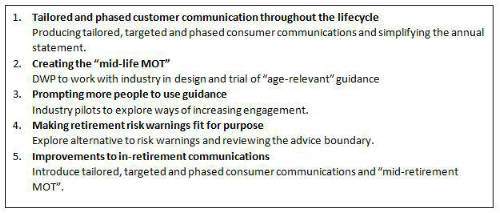

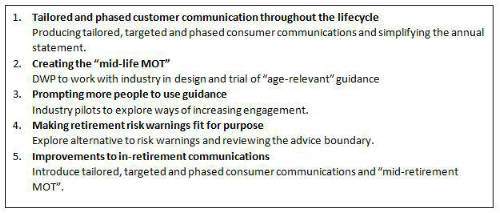

As a result it proposes 5 “interventions” which are targeted at changing consumer behaviour and which it believes will improve consumer outcomes.

The 5 suggested interventions are:

Consumer communications

The ABI believes the statutory requirement to provide wake-up packs 6 months before retirement should be dropped. Not only is this far too late to have a meaningful effect on consumer behaviour, it may actually trigger harmful knee-jerk reactions in the belief that action has be taken within this timescale. Instead consumers should receive a series of communications which are tailored to their age and probable lifestyle.

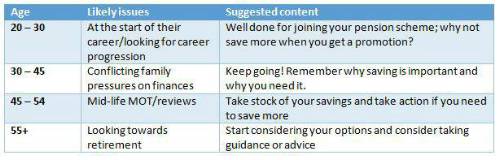

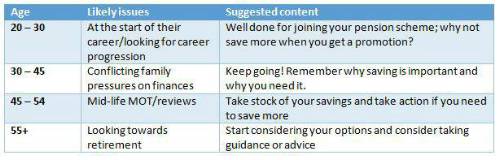

The paper proposes targeting customers by age and tailoring statements to their likely issues in each stage:

There is nothing stopping providers from creating engaging and useful material now and using it, if necessary, on top of current regulatory material. Obviously if the regulator gets on board and revises its requirements that would be even better.

Mid-life MOT

The mid-life MOT was originally proposed in the Cridland report on the State Pension Age, with the aim of persuading people to take stock of their retirement provisions and “make realistic choices” about their future. In practical terms this means changing their focus from how much they are putting into their pension to how much they want out.

The ABI also believes the MOT should not be a one-off event. and that it should be delivered by an impartial third party such as the new single Financial Guidance Body.

Risk warnings and the advice boundary

The report highlights the extremely positive feedback on the Pension Wise service, however take-up has been disappointingly low and the Work and Pensions Committee suggests that a further nudge may be required. The ABI supports this but highlights a number of practical issues, particularly that of timing, which must be addressed.

The issue of the advice boundary is touched on but not discussed in any depth. It is recognised that employers could play a much bigger role as they are more likely to be trusted than an unknown guidance or advice body, and unless they are given the comfort of knowing that they will not come under scrutiny for providing advice they are unlikely to be willing to be involved.

In-retirement communications

The last point is so obvious I am absolutely amazed that no one seems to have thought of it before. Everything that has been written to date deals with pre-retirement communications, however one of the results of pension freedoms is that more and more people are still invested during retirement.

Given the extreme importance of managing income sustainability it is obvious that consumers need more help and support.

Currently this role is largely met by financial advisers, and this is still likely to be the most effective way of creating a personalised financial plan. It should be possible however for providers to continue with age-related communications which extend beyond at-retirement decisions such as the changes that apply to pensions at age 75 and the possibility that people may want to annuitise as their need for security increases?

While we are only three years into pension freedoms, it is clear there is much more that can and must be done to help members achieve better retirement outcomes.

|