Developed and maintained independently by the Centre for Research in Social Policy at Loughborough University, they describe the cost of three different baskets of goods and services, established by what the public considers realistic and relevant expectations for retirement living. These baskets comprise household bills, food and drink, transport, holidays and leisure, clothing and social and cultural participation.

Like the Consumer Price Index (CPI) measure of inflation, the Retirement Living Standards are regularly reviewed to ensure they keep up with changes in spending habits as well as changes to prices on the shelves to remain relevant to real world retirement spending.

Just as the most recent updates to the CPI basket of goods included hand sanitiser and home gym equipment, reflecting changes in buying habits brought about by the pandemic, so too the Retirement Living Standards reflect changing attitudes towards retirement lifestyles post Covid-19.

Researchers from Loughborough University held 13 discussion groups with members of the public from across the UK including both retirees and those approaching retirement (55+) to determine changes to the baskets of goods.

Detailed findings are published in the Centre for Research in Social Policy’s report, ‘Retirement living standards in the UK in 2021,’ which will be launched at the PLSA Annual Conference on Tuesday 12 October.

Changes to the Standards

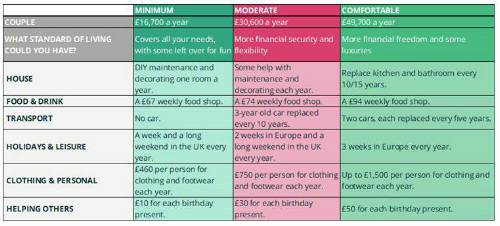

The Minimum Retirement Living Standard is based on the Joseph Rowntree Foundation’s Minimum Income Standard and covers all a retiree’s needs plus enough for some fun - including social and cultural participation. It includes a week’s holiday in the UK, eating out about once a month and some affordable leisure activities about twice a week. It does not include budget to run a car.

The annual budget for the minimum standard has risen since 2019 by £700 to £10,900 for a single person and by £1,000 to £16,700 for a couple in 2021.

Through a combination of the full state pension of £9,339 per year, and auto-enrolment in a workplace pension, this level should be very achievable for most people. About three quarters of single employees are likely to achieve the minimum standard. Everyone who is in a couple, who are able to share costs, can expect to meet the Minimum level simply from having a full state pension entitlement.

Much of the increase has been driven by the rising cost of transport (by road and railway, but not in a private vehicle), which has increased by an average of 10% between 2019 and 2021. The minimum basket also now includes an increase in the budget for hairdressing, from £15 to £25 for women and from £8 to £10 for men, and the inclusion of Netflix, adding around £1.38 each week.

The Moderate Retirement Living Standard, in addition to the minimum lifestyle, provides more financial security and more flexibility.

For example, you could have a two-week holiday in Europe and eat out a few times a month.

The annual budget for the moderate standard has risen since 2019 by £600 to £20,800 for a single person and by £1,500 to £30,600 for a couple.

The eating out budget, which rose from £75 per person per month to £100 per person per month, drove much of the increase for the moderate standard. The budget for social activities was increased from £35 to £50 per week. Increases in Council Tax of 7.5% between 2019 and 2021 have also contributed to the rise. Netflix adds a further £1.38 each week (£72 a year), and price inflation across leisure services and leisure goods combining to add a further £4.72 each week (£246 a year) for one person and £6.52 (£340 a year) for a couple in 2021 compared to 2019.

According to our analysis, around half of single employees are on track to expect a lifestyle between minimum and moderate, and people in a couple who are able to share costs, will be higher in this range.

At the Comfortable Retirement Living Standard, retirees can expect to enjoy some luxuries like regular beauty treatments, theatre trips and three weeks holiday in Europe a year.

The annual budget needed for a comfortable retirement living standard has increased since 2019 by £600 to £33,600 for one person and £2,200 to £49,700 for a couple. About one in six single employees are projected to have an income between moderate and comfortable. Again, many more will achieve this level where they are in a couple and so able to share costs.

As at the moderate level, Council Tax inflation has contributed to the increase in what is needed at the comfortable level, adding £161 a year for one person and £214 a year for a couple. Inflation across leisure goods and services – as at the moderate level – have made a significant contribution to the increase in the overall budget, adding £7.20 a week (£375 a year) for one person and £11.94 a week (£623 a year) for a couple. There was an increase in the amount included for additional food and drink for celebrations throughout the year, such as Christmas, as well as an increase in the budget for hairdressing for both males and females. The cost of annual maintenance and servicing of a burglar alarm was included in the comfortable standard for the first time.

The impact of Covid-19

The PLSA also commissioned the Centre for Research in Social Policy to report on ‘The impact of COVID-19 on thinking about and planning for retirement’.

Many participants said the loss of freedoms as a result of the Covid-19 lockdown had highlighted the importance and value placed upon foreign travel and holidays. The pandemic had reinforced the importance of having choices and opportunities, but also economic security – central concepts and ideas contained within the definitions of the Retirement Living Standards.

What is clear from this research is that the pandemic has prompted people to think about their preparedness for retirement and whether or not they are likely to have the resources necessary to provide the living standard they want.

The updated Retirement Living Standards offer a starting point, moving beyond retirement cliches and stereotypes, in setting out concrete examples of what retirement ‘looks like’ at a minimum, moderate and comfortable standard.

But this is only the start of a conversation. While some people will have been stirred into action by the pandemic – assessing pension plans and savings – many others have not, and finding ways to engage individuals across society in thinking about and planning retirement remains a crucial task.

Nigel Peaple, Director of Policy and Advocacy, PLSA said: “It is important that the Retirement Living Standards remain relevant by reflecting real world price changes and real world expectations about lifestyles in retirement. We hope the updated standards will encourage people to think about whether they are saving enough for the retirement lifestyle they want and, in particular, whether they are making the most of the employer contributions on offer in their workplace pension.

“The lockdowns caused by the pandemic have given many workers a foretaste of being retired and made people think about the activities and experiences they truly value. The pandemic has emphasised the importance of economic security as well as social and cultural participation in retirement. With barbers and hairdressers closed during lockdowns and many of us taking scissors to our own hair for the first time, it is little surprise that the research groups agreed the budget for personal grooming should be increased across the three standards. The addition of Netflix also gives an insight into what many of us expect to be doing when we finish work.”

|