- Average retired person in Wales feels they need an extra £8,835 a year, the highest in Britain

- Using the Open Market Option (OMO) could help increase retirement income by over 50%

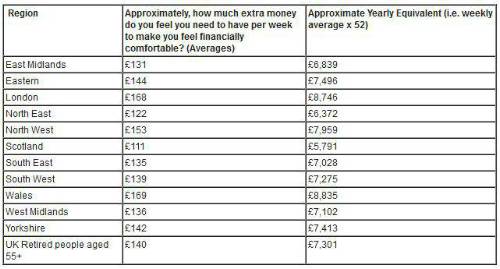

New research1 from retirement income specialist MGM Advantage reveals that the average retired person feels they need an extra £140 a week, or around £7,300 a year, to be financially comfortable. For the retirement nation as a whole, this equates to around £86 billion a year.

However, MGM Advantage says if people shopped around before accepting the annuity rate or product offered by their pension provider, this could increase2 their income by as much as 50%, helping close the gap.

Aston Goodey, Sales and Marketing Director, MGM Advantage said: "Financially, these are difficult times for the retirement nation. Inflation has increased the cost of living, while returns on savings have fallen due to the impact of historical low interest rates. This environment makes it even more important that people take the appropriate steps to ensure they maximise the income from their pension and claim any benefits to which they are entitled.

"With the continued pressure on annuity rates, people should be shopping around to ensure they secure the best product and rate possible. Many people are unaware they might qualify for an enhanced rate due to underlying medical problems, some as common as high cholesterol or high blood pressure."

MGM Advantage has published a checklist of things for people to consider when making important decisions at retirement:

1. Claim all state benefits to which you are entitled, to check, go to www.direct.gov.uk/

Data3 suggests that pensioners are missing out on up to £5 billion a year in unclaimed pension credit, housing and council tax benefits, as well as attendance and disability living allowances.

2. Keep a track on any old personal or occupational pension arrangements, if you think you might have lost track of an old pension arrangement, you can check via the Department for Work and Pensions tracing service here www.thepensionservice.gov.uk/

3. You can check if you have any old savings accounts which you might have lost touch with over the years by going to www.unclaimedassets.co.uk/

4. Don't just accept the annuity rate offered by your pension provider. You should shop around for the best rate and you might qualify for an enhanced rate for pre-existing medical conditions

5. Seek professional financial advice as this will help you get the best product and rate for your individual circumstances, to find an independent adviser go to www.unbiased.co.uk/

6. You may have old National Savings accounts or Premium Bonds, to check for unclaimed prizes please go to www.nsandi.com/files/asset/pdf/Tracing_brochure_v03.pdf

MGM Advantage's recent Annuity Index revealed that the UK's Retirement Nation could raise their income levels by over 50% simply by using the OMO when purchasing an annuity. While annuity rates are at an historic low, the Index shows that the difference in retirement income between the top enhanced annuity rate and bottom standard annuity rate for those aged 65+ with a £50k pension pot is 55.2% for men and 52.2% for women.

Breaking down retirement income needs on a gender basis, MGM's research reveals that the average retired man says he needs an extra £153 a week, compared to £127 for a typical retired woman. Looking at the regions, retired people in Wales claim they need an extra £8,835 a year, which is the highest in Britain. The corresponding figure for Scotland's retired population is £5,791, which is the lowest in the country.

|