-

Lack of pension saving and lingering debts are key reasons for working longer

-

However, one in five are driven by satisfaction and having a lot to offer

-

A year on from pension freedoms, employers’ fears about a ‘skills exodus’ may be overstated

-

But most businesses are unprepared to manage shifting retirement patterns

-

Firms more likely to have plans in place for staff retiring early than working longer

-

Encouragingly, over-65s report a huge feel-good factor at work

The 2016 report – which comprises research among UK private sector employers and employees – has a particular focus on employees aged over 50, following the end of compulsory retirement and with the first anniversary of the ‘pension freedoms’ approaching.

In particular, it asked people what age they hoped they would retire at, before they turned 40. Now, aged over 50, more than one in three (36%) admitted they would be retiring later than they thought – by an average of eight years.

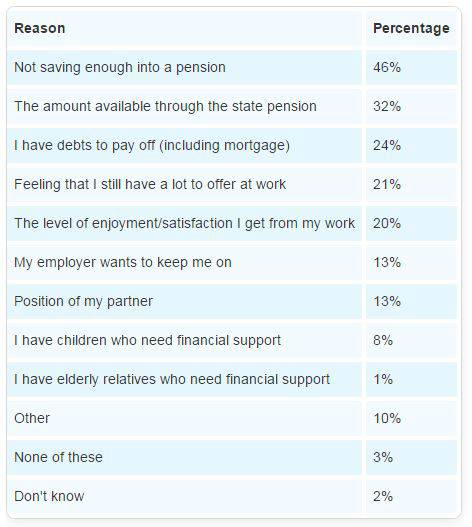

Among those who will now retire later than hoped, the report found that a lack of pension savings (46%) is the primary reason for people to postpone their retirement plans.

The second most common reason for working longer was the amount that would be available through the state pension (32%): making it clear that affordability is a real issue for a high proportion of over-50s.

Not all the reasons given for working longer were negative, though, with one in five (21%) of those expecting to work longer doing so because they feel they still have a lot to offer their employer. A similar proportion (20%) said that job satisfaction has encouraged them to put off retirement.

Fig. 1: Main reasons for over-50s now working later than they hoped

The Working Lives report also reveals a gap between employers’ and employees’ views on the impact of the pension freedoms, as the first anniversary of their introduction in April 2015 approaches.

Over one in five (22%) employers think the freedoms could result in their employees having to work longer to make up for a shortfall in savings if they use part of their pension before retirement. At the same time, almost one in three (32%) employers are concerned they will lose valuable skills because people will retire earlier due to the freedoms.

However, these fears may be unfounded as the vast majority of employees aged 50 and above do not intend to alter their plans because of the pension reforms. Only 8% highlighted that the freedoms will result in them retiring earlier, contrasting with the concerns employers have around loss of skills.

One in ten (11%) employees over the age of 50 now think they will retire at a later date because of pension freedoms, while 9% still remain unsure as to what the eventual impact of the freedoms will be upon their retirement plans. Seven in ten (71%) stated they have no plans to retire or that the pension freedoms have not affected their expected retirement date.

Majority of businesses unprepared for changing retirement patterns

Aviva’s Working Lives report questioned 500 private sector businesses of different sizes about a number of issues, including how prepared they are to deal with changing retirement patterns following the scrapping of the Default Retirement Age and the introduction of pension freedoms.

The findings suggest the majority of businesses do not have plans in place, and that they are less prepared for staff retiring later (just 25% have plans for this) than they are for staff retiring earlier (29% have plans in place).

Even among large companies (250+ employees), less than half (42%) have plans in place should their employees retire later than expected, compared to 14% across both small and medium sized businesses.

Likewise, only 48% of large businesses have plans to cope with staff starting to retire sooner than expected, compared to just 17% of medium sized businesses and only 15% of small businesses.

Workplace satisfaction improves with age

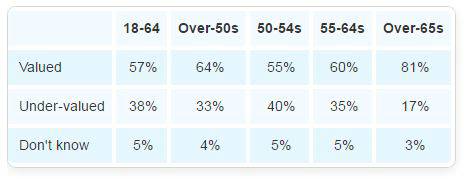

With many over-50s facing a later retirement than they hoped, the Working Lives report nevertheless found encouraging signs that levels of job satisfaction were highest amongst those aged over 65. A large majority (86%) of private sector workers in that age group said they enjoy their work, compared with just 57% of those aged 18-64.

A similar proportion (85%) also said they get a sense of satisfaction from work, while 81% reported being valued by their employer – again, much higher than the younger age groups combined (57%). This backs up the suggestion that there are positive reasons for some people staying in work longer than they originally hoped.

Fig2: Percentage of older workers who feel valued by their employer

Andy Briggs, Aviva UK Life CEO and Chair of Business in the Community’s Age at Work Leadership Team, said: “The findings of the Working Lives report provide an important insight into what is happening in workplaces across the country and the impact of an aging population.

“Whether we like it or not, all the evidence points to the fact that most of us are going to be working for longer than the previous generation did and businesses need to be prepared for that. The report highlights that a lack of pension savings is the main driver for people staying in employment rather than retiring. We are now three years into auto-enrolment which has encouraged millions more people to start making provisions for the future, but there is a still a lot of work to be done.

“The really pleasing thing is to see the amount of value and enjoyment those aged over 65 are getting from staying in work. The business community needs to focus on ensuring that the skills and experience of older employees aren’t lost too early. People who really enjoy their work tend to be more productive and when you couple that enthusiasm with many years of experience you are looking at a very valuable team member.”

Rachael Saunders, Business in the Community’s Age at Work Director, said: “The needs of people in work aged over 50 is a topic that deserves more attention from employers. Just over a year ago we released our own report, The Missing Million, which highlighted the one million people aged over 50 who had been pushed out of the labour market for reasons beyond their control.

“Over 50s bring with them skills and experience that businesses find invaluable. We believe that every effort should be made to recruit, retain and retrain people aged 50+.”

Download Working Lives Report 2016 PDF (1.5MB) below

|