-

Key Retirement warns on risk of savers being attracted to potential scams

-

Enhanced annuities can effectively deliver 7% returns

Retirement savers are striving to achieve annual returns of seven per cent on long-term investments, research from leading over-55s financial provider Key Retirement shows.

Its nationwide study among over-45s found the average return they want from long-term investments is seven per cent – with nearly one in five aspiring to achieve returns of more than 10% on their funds.

Expectations do not fall markedly the older savers become – the over-65s are targeting average returns of 6.7% while those age 60 to 64 strive for 6.8%.

The high expectations among savers persist despite more than five-and-a-half years of the Bank of England base rate being stuck at an historic low of 0.5% and recent stock market volatility. The Financial Conduct Authority has set maximum gross rates of return before charges for projections at two per cent, five per cent and eight per cent.

Currently the best rate** on a five-year savings bond is less than half the seven per cent target, at 2.96% before tax, while on a three year bond it drops to 2.4%. Even the Government’s planned Pensioner Bonds for the over-65s will only pay 4% on a three-year bond.

Key warns that investors’ high expectations could put them in danger of accepting riskier – or even illegal – investment options, taking more risk than they would otherwise be prepared to accept. It highlights enhanced annuities may be a more appropriate route for many retirement savers to achieve effective returns, typically in excess of six or seven per cent.

Key believes the views on investment returns highlight the need for expert advice and guidance on retirement options ahead of the launch of pension flexibility in April 2015.

Dean Mirfin, group director at Key Retirement, said:

“Recent experience shows that achieving annual returns of seven per cent on long-term investments can be challenging unless savers are willing to take a very long-term view or accept high levels of risk.

“People converting their retirement funds to income cannot afford to wait up to 10, 20 or 30 years for a long-term return and also may not be willing to accept high levels of risk which could leave them open to taking out schemes they do not fully understand.

Many do not appreciate that rates of return can be erratic and can also fall into negative returns some years.

“It underlines the need for expert advice on what is realistic now and in the future so that retirement savers can make the best of the genuine opportunities from pension flexibility, in a way that delivers true expectations.”

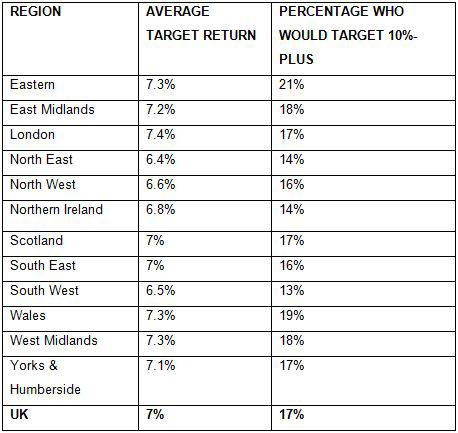

The table below shows the breakdown across the country – over-45s in London have the highest average target returns at 7.4% while those in the North East are the least ambitious at 6.4%.

|