Review of 2011

Investors have had a difficult year. With stubbornly high inflation to contend with in the eurozone, the UK and the US, weak macroeconomic data and a rise in market volatility, achieving a real return on capital has been a challenge. Stock markets have fallen around the world and yields have risen in many credit and government bond markets.

The award for the most surprising winners of 2011 must be UK and US government bonds, which have been the beneficiaries of an increasingly narrow definition of what constitutes a safe haven in the investment world. Far from falling in value due to worries that quantitative easing (QE) would result in runaway inflation, as some feared in January, many investors have favoured them because the UK and the US can print the money needed to repay debt, unlike the eurozone countries.

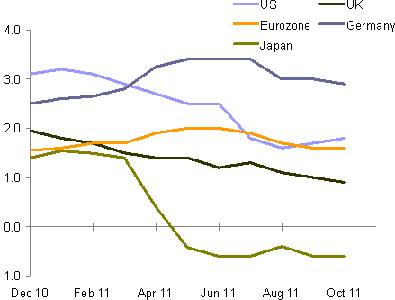

Driving the disappointing stock market returns have been disappointing economic data and a slow policy response to events in the eurozone. Global growth has been steadily revised down, from what were in any case modest initial projections (see graph below), while the eurozone debt crisis has got to such a level as to threaten the sustainability of the single currency itself. Across the Atlantic in the US, still the world's largest economy and with one of the world's most flexible labour forces, we appear to have a serious structural - not a cyclical - unemployment problem.

The disappointing year...downgrades to 2011 GDP growth forecasts

Source: 2011 GDP estimates, Blue Chip, Bloomberg, J.P. Morgan Asset Management

Furthermore, in March a tsunami and a subsequent nuclear power plant explosion severely disrupted output in Japan, the world's third largest economy. There were knock-on effects on supply chains around the world, particularly for the auto and technology sectors.

These themes were the driving forces behind the fall in growth expectations seen in 2011, particularly in the second half of the year, which in turn led to a lowering of corporate earnings growth forecasts.

Behind many of the macroeconomic problems lies a weak banking sector in Europe and the US, which is still suffering from the after- effects of the collapse of Leman Brothers in 2008, and is still struggling to rebuild balance sheets full of property-related and/or eurozone sovereign debt. The reluctance of European and US banks to lend into the ‘real' economy has been a significant contributor to the disappointing growth after the initial recovery of 2009-2010, with lending to small and medium sized companies (which provide the bulk of employment growth within the OECD) severely restricted.

Unsurprisingly, by sector the weakest stocks on global stock markets have been financials, followed by other economically-sensitive sectors such as industrials and materials. These ‘high beta' sectors tend to underperform when the broader market indices fell, and outperformed during periods of recovery. As a result they have provided trading opportunities for the nimble investor since the late summer, when many stock markets established broad trading ranges that have - by and large - persisted.

However, for the year as a whole, defensive sectors outperformed, with relatively slight losses from sectors such as consumer staples and healthcare. The blue-chip stocks in these sectors benefited from relatively high dividend yields (backed up by strong balance sheets) and a growing exposure to emerging market consumer demand.

Emerging market equities whole fell in line with developed markets, despite much more robust economic growth. The reasons were twofold: first, tighter monetary policy in the emerging markets as central banks sought to bring down inflation; and second, downgrades to GDP growth forecasts on the back of weaker growth in developed economies. Since the autumn there has also been an increasing problem in obtaining trade finance from European and US banks, as they seek to selloff assets in emerging economies in order to help rebuild their balance sheets.

2012 Outlook

At least one key event that troubled markets in 2011 will almost certainly continue to reverberate in 2012: the eurozone debt crisis. Even if a definitive solution is soon found, the economic damage has been done and all the countries in Europe will suffer lower growth because of it. After years of lax fiscal policies, the planned cuts in debt-to-GDP ratios means a fiscal contraction of €150 billion in 2012, with more to follow in subsequent years. Growth will be fortunate to reach 0.5% and the reforms required to boost economic competitiveness will take years to bear fruit. The adjustment in the UK will be similar and with global growth weak the country cannot rely on exports to offset the domestic contraction.

It is outside of Europe that the outlook is a bit brighter. In the run-up to the US election, both fiscal and monetary policy is likely to stay expansionary. Investors remain indulgent about the country's level of indebtedness as the Treasury market is still unrivalled in its size and liquidity. Japan will continue its recovery from the earthquake and tsunami. Elsewhere in Asia, growth will inevitably slow as trade with Europe drops, but GDP expansion will still outstrip any other region of the world. Latin America's commodity exports to China will continue and rising internal demand will benefit both Brazil and Mexico.

High levels of risk aversion thanks to the eurozone crisis means that traditional safe haven assets offer little potential return. Core sovereign debt yields are well below what expected nominal GDP growth rates would suggest is reasonable. For example, US ten-year Treasury yields have averaged about 50 bps more than nominal GDP since 1982 (when US inflation finally dropped below 5%). With the US economy forecasted to expand by at least 4% over the next five quarters (again, in nominal terms), ten-year yields should be much higher than their current levels around 2% (quantitative easing explains part of this divergence). Gold, which is traditionally seen as a hedge against inflation, is at risk because an escalation of the eurozone crisis would likely be deflationary, and a rising dollar due to a flight to quality would also hurt gold prices.

The asset classes that we believe offer the best potential returns over the next year include higher yielding fixed income, such as emerging market debt (both USD and local currency), as generous coupons, falling risk aversion and appreciating currencies all argue for positive total returns. Corporate high yield debt also looks attractive as companies generally have sufficient cash to make interest payments and current spreads suggest a much higher default rate than we think is likely. Equities should recover some of their losses from 2011 as the outlook in Europe improves and valuations are attractive, but earnings growth will be hard to come by, moderating gains. Stocks with better dividend yields should provide some additional cushion.

|