RISE OF THE DISRUPTORS: 21st CENTURY INSURERS OUTNUMBER INCUMBENTS MORE THAN TWO TO ONE

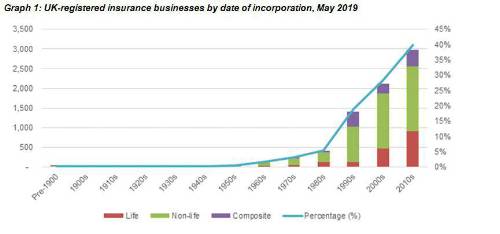

Its study of Companies House data shows two in five (40%) insurance businesses in the life and non-life insurance sectors have emerged in less than a decade since 2010. An additional 28% were founded between 2000 and 2009.

In contrast, fewer than one in five (19%) active firms were established in the 1990s, with the remaining 13% dating back to 1989 or earlier.

Average UK insurer is 16 years old

Last year alone saw 504 new entries registered with Companies House, equivalent to more than one per day throughout 2018.

The pace of business population growth has accelerated again in 2019, with 216 registrations in the first four months of the year – nearly two per day – as insurtech investment rises¹. At the other end of the spectrum, the sector continues to boast nearly 60 ‘centurion’ businesses who have been active for 100 years or more.

Despite the wave of market entrants, the average UK insurer is currently 16 years old with an incorporation year of 2003. This predates a host of technological innovations which have impacted consumer behaviour and business operations, including the launch of iOS, Android, Amazon Web Services, Facebook, Twitter, Gmail, WhatsApp and Instagram.

Disruption hotspots: London leads the way

London is firmly established as the home to more than a third (35%) of UK insurance businesses, including 30% of 21st century firms as well as 45% of those with pre-2000 origins.

Beyond London, Grantham, Leeds, Manchester, Bristol and Birmingham make up the next five insurance start-up hotspots – accounting for a combined 6% of 21st century businesses.

Across the UK, three in five (60%) businesses to emerge in the 21st century have been focused on general or commercial insurance activities: more than twice as many who are focused on the life sector (27%). The remaining 14% are composites insuring both life and non-life risks.

Adam Powell, Co-Founder and Chief Operating Officer of Policy Expert, commented: “These findings show that exponential growth is making the UK insurance space more vibrant and competitive by the day – driven forwards by entrepreneurial ideas and tech-led innovation.

“The rapid rate of business creation means a horde of start-ups are rubbing shoulders with firms that are generations apart in terms of experience. Many firms – both old and new – are still chasing the holy grail of combining innovation and scale. In today’s competitive climate, it’s not enough for new propositions to stand out from the crowd, unless you can convert the crowd into loyal customers by offering something above and beyond the insurance status quo.

“Our journey from selling our first policy in 2011 to disrupting the top 20 UK home insurers has been built on transparent policies, fair pricing and attentive customer service, backed by agile technology and data analytics. This formula has driven Policy Expert to bridge the gap between start-ups and incumbents, with over 2.3m policies sold and 550,000 live customers to rank among UK insurtech’s biggest successes to date.

“Today’s market offers great potential for firms who are agile enough to unlock it, and we are excited to keep pushing the boundaries to generate customer goodwill and business growth.”

|