New research, using longitudinal data from the English Longitudinal Study of Ageing and published today by the Institute for Fiscal Studies finds that:

Women who were unaware of their SPA in advance were less likely to respond by being in paid work beyond age 60;

Women who were not in paid work at age 58 did not become more likely to re-enter the labour market at age 60 after the SPA had risen;

Women with lower levels of wealth, and those who were not homeowners, were also less likely than others to respond to the reform by being in paid work after age 60.

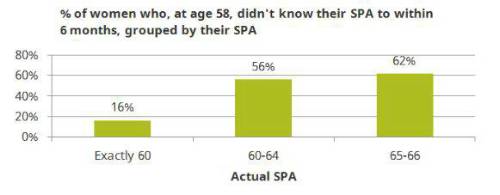

The chart below shows that, a majority of women whose SPA was increased by the reform did not know their true SPA to within 6 months when asked at age 58. Furthermore, a sizeable minority (39%) of women whose SPA had been increased did not know their actual SPA to within a year.

Women who did not know their SPA to within 6 months did not change their employment behaviour at ages 60-63. This could be because some women did not consider their SPA in making retirement plans. Alternatively, women who had incorrect beliefs about their SPA may have made retirement plans and been unwilling or unable to change those plans upon discovering their actual SPA.

The SPA increase had no positive effect on employment at ages 60-63 among women who were not in paid work at age 58, nor on those in receipt of benefits aged 58 (unlike those in work and those not in receipt of benefits, among whom employment rose in response to the reform). This may be because they were less able to respond to the rising SPA. A third of those receiving benefits aged 58 were in receipt of disability benefits, and 25% were in receipt of incapacity benefits.

Women with net financial wealth below £8,000 are less likely to have been in paid work at ages 60-63 as a result of the SPA increase than their wealthier counterparts, whilst women who do not own their own home have, on average, not responded at all to the increase. This suggests that those with the fewest private resources to draw on in the absence of state pension income may have been least able to make up the shortfall by being in paid work.

We find no evidence that increasing the SPA had negative effects on measures of wellbeing. For example, there was no increase in reported social isolation or self-reported loneliness, on measures of depression or self-reported quality of life.

Neil Amin-Smith, a research economist at the Institute for Fiscal Studies, and a co-author of the new report, said, “The rising state pension age has affected women differently according to their characteristics and awareness of the reform. Less wealthy women, and those out of work or on benefits aged 58, are less likely to have replaced their delayed state pension income with income from employment. Those who were relatively unaware of the reform in advance – which is a majority of these women – did not become more likely to be in paid work as a result of the increase to their state pension age.

The female State Pension Age is continuing to rise. And from December the male State Pension Age will rise too. Some may not want to adjust their employment plans in response whilst some may not be able to. But better information about the increases could help others to be in paid work for longer.“

|