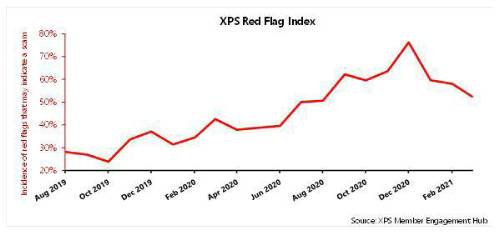

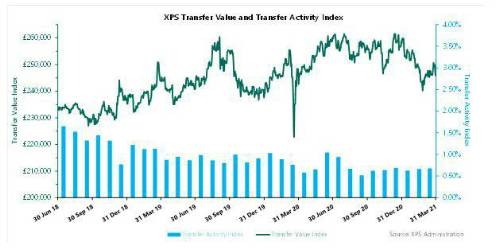

The Transfer Activity Index remained steady, whilst the Red Flag Index showed a further small decline in red flags detected by XPS’s Scam Protection Service, with one or more flags identified in just over half of all transfers processed in March.

XPS Pension Group’s Transfer Watch monitors how market developments have affected transfer values for a typical pension scheme member. It also monitors how many members are choosing to take a transfer from their DB pension scheme and, through its Red Flag Index, the incidence of scam red flags identified at the point of transfer.

In March, the Financial Conduct Authority (FCA) issued its long-awaited final guidance for firms advising on pension transfers, setting out its expectations and highlighting examples of poor practice. Alongside this, the FCA have published a joint guide with the Pensions Regulator (TPR) for employers and trustees looking to support members without straying into advice.

Mark Barlow, Partner, XPS Pensions Group commented: “The joint guide from the FCA and TPR provides welcome clarity for the many schemes who want to help their members when they’re considering a life-changing decision like whether to transfer their pension. It is particularly helpful to see the guide acknowledging the valuable role that employers and trustees can play in supporting members in accessing high quality financial advice.”

Helen Cavanagh, Consultant, XPS Pensions Group added: “We are pleased to see the continued fall in the Red Flag Index. However, more than half of cases are still showing warning signs that could indicate a scam, or at the very least, the potential for poor member outcomes. This remains much higher than the level of red flags we were seeing before the pandemic.

Our scam protection service is identifying many cases which are described as being ‘poor practice’ in the new FCA guidance. We are also seeing that the additional disclosure requirements introduced last year are not being met by some advisors, and we hope that this guidance will help to increase standards.”

Chart 1 – XPS Transfer Value and Transfer Activity Index

Chart 2 – XPS Red Flag Index

|