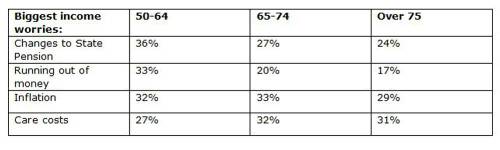

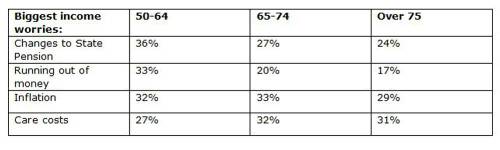

• Nearly two fifths (36%) of people approaching retirement age think the biggest risk to their income is the potential that the state pension will be less generous in the future

• Inflation is the biggest concern for those in early retirement, and for those aged over 75, social care costs top their income risks

For those aged 50 – 64 years old, pre-retirement anxiety centres around the future of the state pension, with over a third (36%) believing that changes to the state pension could be an issue. Indeed, according to official figures, almost half of pensioners’ household income2, some £214 a week, comes from state benefits, making it a financial lifeline for many.

However people in this age group are also concerned about running out of money (33%), closely followed by impact that inflation can have (32%) and paying for care costs in later life (27%).

For those currently in retirement, changes to the state pension don’t rank as highly, with just 27% of 65 to 74 year olds citing this as their top concern, and this falls to 24% for over 75s. The government has recently pledged to keep the “triple lock” in place for the rest of this parliament and those already in receipt of the pension perhaps rightly assume, the government is unlikely to make big changes to existing payments. John Cridland is currently carrying out an independent review of State Pensions Ages, so more change is coming, although the government has previously said it will give those approaching retirement, at least ten years notice of any change.

For a third (33%) of people in the early phase of retirement, aged 65 - 74, inflation is the key worry when thinking about their retirement income. The Bank of England’s Monetary Policy Committee recently signaled that it expects inflation to pick up in the coming year4 following the UK’s decision to leave the EU, and this has the effect of reducing pensioner’s incomes in real terms, especially with goods and services rising at the same time.

While inflation is still a concern for those aged 75 and over, this is the point when concern over care costs come to the fore. Research has shown that depending on where someone lives in the country, care can cost an average of £29,250 a year for a care home and as much as £39,300 per year3 if nursing is required. Nearly one in three (31%) over 75’s believe this is the greatest risk to their retirement income. And these fears are justified, especially when you consider that the average yearly income for over 75s is £20,6441.

Kate Smith, Head of Pensions at Aegon said: “It is clear that people’s concerns about their income change as they get older. So many rely on the state pension to underpin their income so it is unsurprising to see that such a large proportion fear any change to the amount they receive. This is particularly true for women, many of whom have been unfairly disadvantaged by relatively recent changes to the state pension, and are more reliant on a State pension than men for their retirement income. We hope John Cridland’s review of state pension will outline suggestions as to how we ensure the state pension balances affordability, with fairness given that not everyone will lead longer healthier lives, and that any changes are effectively communicated.

“We’ve been living through a period of low inflation in recent years, but with the UK voting to leave the EU, the value of the pound has fallen dramatically recently. Over time this is likely to lead to higher prices as the cost of imports rise. Inflation has long been the enemy of those on fixed income and unless people have taken steps to protect the real value of their money, its effects can be difficult to mitigate.

“Care costs are the main income concern for over 75s which is understandable given the high cost of care. We’d like to see the government scrap the pension lifetime allowance which is currently set at £1m. Having a more generous allowance would allow future retirees to set more aside for later life costs like care and while £1m sounds like a lot, many of those who save seriously from an early age will hit this figure.”

Download the full report by clicking here

|