PwC’s Buyout Index also continues to show that, on average, UK DB schemes have sufficient assets to ‘buy out’ their pension promises with insurance companies, with a surplus on this measure of £165m. In theory this means the majority of pension scheme liabilities could be transferred to insurance companies, although that would take over 25 years based on recent annual deal flow.

John Dunn, head of pensions funding and transformation at PwC, said: “Although the UK’s DB pension schemes remain in a strong surplus, at an individual scheme level, the picture is much more diverse. While many schemes will be in a position where they are now unlikely to ever need more money to be paid in, others will still be some way off, particularly those negatively affected by the Liability Driven Investment (LDI) crisis last Autumn. These schemes will need a clear statement of strategy, setting out how, and when, they’re going to get to a low dependency funding and investment position - as well as potential cash top-ups.”

“The PwC Low Reliance Index uses a discount rate that is the same as The Pension Regulator's (TPRs) proposed benchmark for its ‘Fast Track’ low dependency approach. Given the current strong funding position, we’d expect a significant proportion of schemes to opt for Fast Track valuations when this option is introduced later this year. Fast Track valuations will automatically get the green light from the Regulator, so by taking this route sponsors and trustees can be confident that they have complied with all the funding rules.”

Laura Treece, pensions actuary at PwC, added: “Even though the Regulator’s new funding code isn’t expected to come into force until later this year, it’s still essential that sponsors and trustees start to think about how it impacts their scheme’s funding and investment arrangements. One of the many things to consider is whether they are likely to meet the requirements of Fast Track - both in terms of how they measure their liabilities, and in other areas including the stress tests and recovery plan requirements. Initial tests using PwC’s Fast Track:FiT tool, which assesses the different elements in a single diagnostic, shows that many schemes will be able to pass Fast Track with a few simple tweaks to the funding and investment strategy. However, others will require more significant changes."

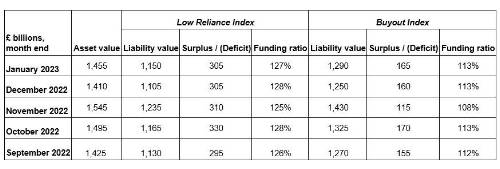

The PwC Low Reliance Index and PwC Buyout Index figures are as follows:

|