Figures for the first half of 2019 show that theft or attempted theft now make up one in five (20%) of Policy Expert’s accepted home insurance claims. This is the highest percentage recorded in the last seven years, up from 18% in 2018 and 15% in 2013.

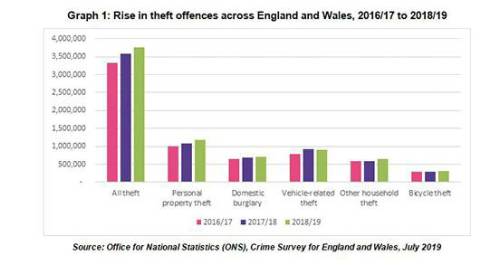

As a result, theft has become the insurer’s second biggest source of claims, rising above escape of water and second only to accidental damage. The trend comes as the latest government data shows England and Wales have experienced a double-digit rise in overall theft offences from 2016/17 to 2018/19 – bringing an end to a period of declining theft across the country.

Total offences across England and Wales have increased by 13% in the last two years to 3.75m per year. This has been driven by an 8% rise in domestic burglary and bicycle theft; a 14% increase in vehicle-related theft; a 17% jump in personal property theft; and an 11% increase in other instances of household theft.

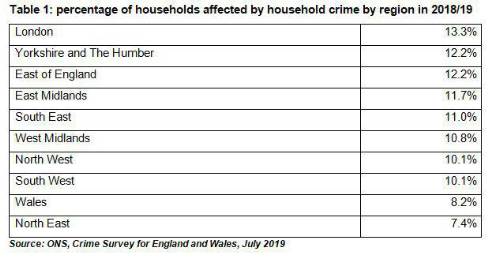

Comparing regional trends for household crime¹, the North East was the safest region in 2018/19 with just 7.4% of households falling victim. At the other end of the scale, London’s household crime rate was almost twice as high with 13.3% of households affected.

The East of England was jointly the second most affected region along with Yorkshire and the Humber: both saw 12.2% of households impacted by household crime in 2018/19.

Adam Powell, Co-Founder and Chief Operating Officer of Policy Expert, commented: “Improving home security measures were previously credited with helping to reduce levels of property crime². With theft now on the rise both in and out of the home, people are taking steps to ensure their property and belongings are secure.

“Today’s tech-enabled world offers a range of hardware and software to improve safety and combat theft, from locking down homes to tracing personal possessions. It also introduces new risks that tech itself becomes a target of theft or a source of vulnerability if it fails.

“As well as evolving policies to keep pace with technology, rising theft makes it vital that the insurance industry gets the basics right when assessing risk and ensuring customers have the right cover for their needs. Our proprietary software and in-house data analytics ensure we understand risk profiles at a granular level, down to individual properties and customers, to keep pricing low. We’ve also engineered our customer journey to re-confirm that consumers have chosen the right level of cover for their property and possession, to minimise instances of re-pricing, cancellations and unsuccessful claims after the point of purchase.”

|