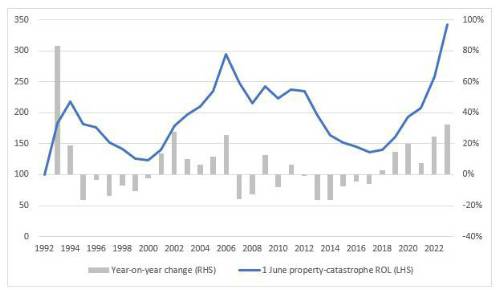

This follows an uptick of 25% in 2022 that brings the index at 1 June to its highest level since inception.

The increase was underpinned by enduring, low levels of capital to risk – although this is starting to shift – in addition to an ongoing confluence of global and local pressures. Hurricane Ian loomed large with varying loss impacts by cedent. Portfolio trends and Florida concentrations affected risk-adjusted rate changes with loss-affected programmes in some cases experiencing increases exceeding 40% depending on loss scale and effect. Higher layers also saw increases in excess of 40% year-on-year, notably affected by new minimum rate-on-line thresholds. This was the case for both earthquake and wind covers.

“In this once-in-a-generation market, it is critical to ensure clients can secure the coverage they need,” stated Wade Gulbransen, Head of North America, Howden Tiger. “Given strong rate hardening, the need for strategic planning and dynamic placement strategies has become paramount. This isn’t just about finding capacity, it's about finding the right capacity that fits our clients’ risk profiles and financial objectives while adapting to an industry in transformation.”

Risk-adjusted property-catastrophe reinsurance rate-on-line index at 1 June

Source: NOVA

Strong, early market engagement leads to capacity availability

Markets were strongly engaged in the lead-up to renewal where products, premium and limits fell within risk tolerances. The trend of private placements evident in prior renewal cycles continued, but mainly as a play for early capacity as opposed to shortfall cover. Marketing for many 1 June programmes began in late January with strategic placements setting the tone as early as March when noticeable appetite for higher layer risks from both traditional and ILS capacity providers emerged. Dynamics in lower layers remained challenging with cedents increasing retentions and, in some instances, altering underwriting guidelines. Capacity was available given the right structures and price points as reinsurers moved up the curve with higher layer participations finishing over-subscribed in some areas. Higher pricing and additional reinstatement premiums were characteristic of lower layers.

Global factors are reshaping the reinsurance market landscape

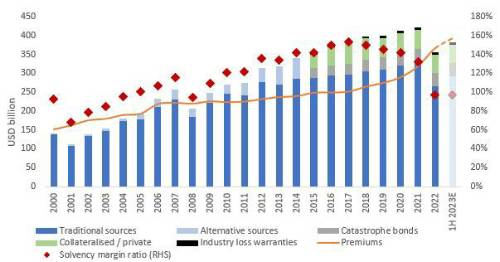

Financial market volatility, inflation, geopolitical tensions, recent weather losses and the Turkey earthquake all weighed on underwriters as they allocated capital. This was mitigated by a moderate recovery in dedicated reinsurance capital since the beginning of the year, and by legislative reforms in Florida.

“The reinsurance market is in a transformative period, shaped by a coalescence of events”, said David Flandro, Head of Industry and Strategic Advisory, Howden Tiger. “Although dedicated reinsurance capital has recovered somewhat since its low at the beginning of the year, challenges persist with historically high catastrophe losses, heightened geopolitical and financial risks and increased connectivity converging to create a climate of amplified risk aversion.”

Dedicated reinsurance capital and gross premiums 2000 – 2023E

Source: NOVA

Note: 1H 2023E dedicated capital is an estimate only based on current market factors that can change; 1H 2023E premium estimate is annualised.

In summary, risk-adjusted property-catastrophe pricing at 1 June has reached new high with multiple factors altering the landscape of risk management. Low – albeit recovering – levels of dedicated capital persist. The industry is in a period of heightened risk aversion and stands at a crossroads, demanding strategic adaptability and expertise to navigate changing market dynamics.

|