|

|

By Omar Ripon, Partner, Risk & Capital Advisory at Mazars

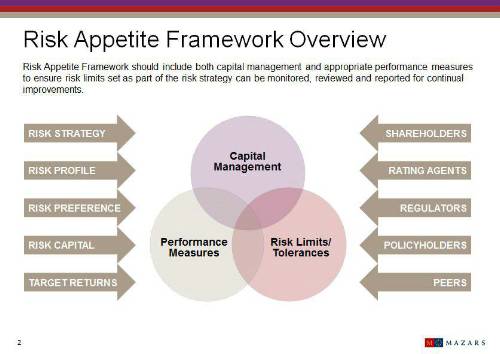

Risk Appetite Framework Overview

Risk Appetite at a high level is a simple formal statement of what risks an insurer is willing to accept given its business objectives. However, Risk Appetite Framework is much broader and encompasses a number of related management activities such as capital management, measuring performance and monitoring risk limits. Understanding and utilising the risk-reward mechanism is perhaps one of the most important commercial challenges for insurers operating under a risk based capital regulatory environment.

This is not surprising given there are so many internal variables such as risk strategy, target risk profile, required expected

return, capital buffer, target risk capital etc. to consider, set and manage as well as ensuring external stakeholder expectations (primarily Regulators, Shareholders, Capital Markets, and Rating agencies) are fully met.

In simple terms when a firm writes insurance business it accepts explicitly and implicitly insurance risks, financial risks and operational risks and then the question arises: How much risk? What type of risks to accept? What return do shareholders want? What level of security do policyholders want? What level of service do I want to give to policyholders? What business can my capital support? What line of business gives me the most ‘buck for my bang’ and why? Do I have enough risk capital to manage volatility beyond best estimate reserves? The list of questions is vast but they can all be best addressed or and managed by setting a risk based strategy which takes into account risk capital, target risk profile, performance measures and risk limits.

How do you set, quantify and measure your risk strategy?

An insurance firm’s risk strategy cannot sit in isolation separate from operations. Effective risk strategy implementation requires the firm to consider how its strategy can be translated to a target risk profile and how it can be measured. Implementation of the risk strategy is an iterative step process and will require asking some tough question such as: What do we actually do and is that the right business for us and why? For most insurance firms the answer is relatively simple but for significant numbers it may be hard to admit that they don’t have the right enablers or process and procedures to set a target risk profile and monitor and measure the risk performance for commercial benefit.

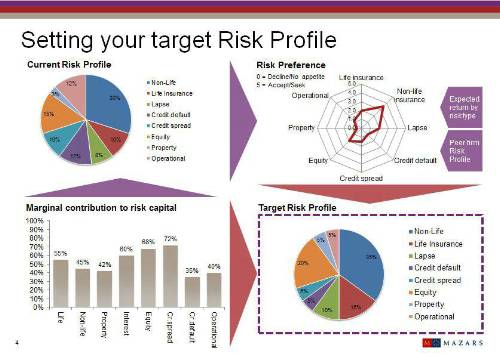

Setting the target Risk Profile is a combination of art (judgment) and risk modelling science.

What do we view as Industry good practice? Clearly the starting point is the firm’s current risk profile which can be measured using the standalone capital numbers for each risk class that are derived from ICA or SCR calculations. The next step is to construct a marginal capital contribution table for each of the key risk classes. The marginal capital is basically the amount of capital a risk adds to the total diversified capital per unit of risk. These processes and resulting output provide a good set of information and measures for the firms’ management to select its preference for certain risks.

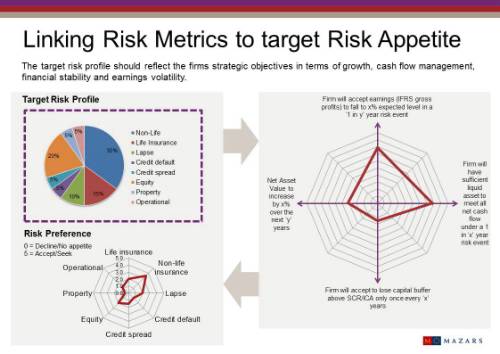

The most challenging part is to formulate sensible decisions around which risks are preferred given the organisations capability to manage a particular risk. The inputs into this are: • Level of resource and business model in place to manage a particular risk • Peer risk profile: “Is there anything our competitors are doing that we want to be doing”…..if so adjust your risk acceptance. • What return do shareholders expect? The target risk profile should also reflect the firm’s strategic objectives which are typically set in terms of growth, cash flow management, financial stability and earnings volatility. The risk preference is then reflected in an updated risk profile – the target risk profile. But these need to be translated into risk language. For example a typical strategic objective statement may be “we will accept loosing all capital buffers in a 1 in 10 year adverse risk event” or “we will hold sufficient liquid asset to meet all net cash flow under a 1 in 20 year adverse risk event”. The above approach and methodology is not an exact science but it does tie management decisions with risk capital modelling output and it does give an insurance firm a solid framework for future enhancements. Having set the target risk profile to achieve a target performance; the next task for firms is to measure it in a meaningful way so that the management can understand it, and if necessary take appropriate course of action. The performance measure needs to be appropriate to the risk being accepted. If a firm is not able to measure effectively what risk capital it has allocated to the key risks (explicitly or on a notional basis) and monitor its movement in time then it’s back to the drawing board because it is bad management practice to accept profits without understanding what risks were accepted in the process, and because the next time the firm may not be so lucky! The more granular understanding a firm has of the risks performance the more flexibility is has in running the business strategy as planned and more flexibility it has in changing the course if things go wrong! A typical risk measure widely employed by our clients is target capital buffer which is expressed as percentage of the Solvency II SCR or INSPRU ICA e.g. “The firm will maintain a capital buffer between 120% and 140% of SCR”. Setting and managing Solvency corridor as percentageof SCR (or ICA) is a practical method of aligning internal risk capital to regulatory capital and to understand the firms actual risk performance over time. Capital requirement can be then measured at a point in time to assess if target profile is on course. Mazars has also seen a number of leading life insurance firms in the industry set risk appetite limits based on projected earning deviation (Actual earning/projected earnings). For example, a firm could test projected earning deviation between current assumptions against various ‘what if’ scenarios to decide if the current risk strategy and risk profile needs revising. There is a clear relationship between performance metrics and risk metrics. Firms should set risk metrics that correspond to performance metrics in order to understand the effectiveness of its risk strategy. However, firms should not be tied to just target capital buffer measures or earnings deviations and need to select and implement a set of risk measures that provides the best information on their risk performance. Some common risk metrics and performance measures are listed below.

The more advanced firms also employ Economic performance measures such as Economic Value (EV) which is an absolute measure.

Economic value (EV) creation can be measured in absolute terms allowing for risk adjustment and cost of capital. However, care needs to be applied in their use and interpretation. EV is simply risk based capital profit less a Hurdle amount; the Hurdle is driven by the cost of capital. Traditionally the hurdle amount is the cost of capital rate multiplied by the Economic capital held; the Economic capital is typically held at a higher probability confidence level then the 99.5% confidence level set by the regulators. For larger life insurance group firms a cost of capital rate of around 15-20% rate is not un-common. A more sophisticated EV is calculated by considering a required return for risk taking plus a Frictional cost of capital. The required return is for accepting inherent market risk while the Frictional cost of capital arises due to the loss of control in investing indirectly in a life office.

Conclusion – Closing remarks

Risk appetite framework can only be implemented and embedded if there is an effective governance framework around the risk appetite setting process. The risk function is responsible for formulating and cascading the risk appetite statements, articulation of tolerances, risk limits and targets to the operational units. The risk performance metrics needs to be integral to the risk appetite framework and firms should adopt a set of risk measures that readily align with strategic objectives and existing operational performance indicators. However, these needs to be supported by business processes to ensure the risk limits and tolerances are understood, monitored and reported for management action. The level of reporting also needs to be enhanced to meet both internal and external requirement but that is a whole new chapter!

To download the complete set of slides in PDF please click here

Mazars has assisted number of insurers with designing and implementing its risk appetite framework for commercial value derivations and would be delighted to discuss your needs. Please contact omar.ripon@mazars.co.uk, T: +44 (0)20 7063 4234 / M: +44 (0)7796 442 226

|

|

|

|

| Take the lead client-facing projects ... | ||

| Various locations - Negotiable | ||

| Choose Life! Choose a major global co... | ||

| Various locations - Negotiable | ||

| Actuarial skillset? Apply now for Snr... | ||

| South East / hybrid with travel requirements - Negotiable | ||

| Financial Risk Leader - ALM Oversight | ||

| Flex / hybrid - Negotiable | ||

| Be the very model of a modern Capital... | ||

| London - Negotiable | ||

| Pensions Actuary seeking a high-impac... | ||

| London or Scotland / hybrid 3dpw office-based - Negotiable | ||

| Great opportunity for Pensions Actuar... | ||

| London or Scotland / hybrid 3dpw office-based - Negotiable | ||

| Responsible Investing Manager - Clima... | ||

| London/Hybrid - Negotiable | ||

| Quant Strategist | ||

| London/Hybrid - Negotiable | ||

| Multiple remote longevity contracts | ||

| Fully remote - Negotiable | ||

| Multiple remote inflation hedging con... | ||

| Fully remote - Negotiable | ||

| Play a vital role in shaping a new He... | ||

| London or Scotland / hybrid 50/50 - Negotiable | ||

| Support the Longevity team of a globa... | ||

| London / hybrid 2 days p/w office-based - Negotiable | ||

| Delve into financial risk within a ma... | ||

| Wales / South West / hybrid 1dpw office-based - Negotiable | ||

| Project-based Life Pricing Actuarial ... | ||

| South West / hybrid 2 dpw office-based - Negotiable | ||

| Pricing Actuary | ||

| London - £120,000 Per Annum | ||

| Develop your career in motor pricing | ||

| UK-wide / hybrid 2 dpm office-based - Negotiable | ||

| Experience real career growth in home... | ||

| UK-wide / hybrid 2 dpm office-based - Negotiable | ||

| Be at the cutting edge of technical p... | ||

| UK-wide / hybrid 2 dpm office-based - Negotiable | ||

| Use your passion for innovation and t... | ||

| London / hybrid 2 days p/w office-based - Negotiable | ||

Be the first to contribute to our definitive actuarial reference forum. Built by actuaries for actuaries.