By Nikhil Patel, Principal and Senior Risk Transfer Actuary and Rosie Fantom, Head of Bulk Annuities and Risk Transfer Partner at Barnett Waddingham By Nikhil Patel, Principal and Senior Risk Transfer Actuary and Rosie Fantom, Head of Bulk Annuities and Risk Transfer Partner at Barnett Waddingham

The risk transfer market is continuing to break records, and this will continue in the coming years based on the transactions already in the pipeline and as insurance ultimately remains the right solution for many schemes.

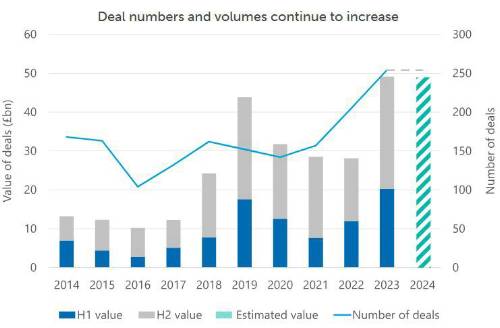

"Figures for 2023 reveal that just shy of £50bn of liabilities were transferred to insurers last year and we expect this to be matched or exceed in the coming years. The exact profile of annual transactions could be "lumpy" as mega deals (£10bn+) in the market mean one year may be more exceptional than another, but we believe that overall, c£50bn per annum could be the new norm."

These mega deals have implications for others seeking transactions. It’s possible that these transactions absorb almost all the capacity from one or two insurers over a period. Other medium to large schemes may well find that an opportunistic market approach strategy could be one to bear in mind. Keeping in regular contact with insurers during transaction preparations, and being ready to consider engaging with a subset of insurers slightly earlier than planned if a pricing opportunity opens up.

The number of deals completing in any year is another important indicator of busyness and capacity. With over 225 deals completed in 2023, up from 200 transactions in 2022, this shows insurers and advisers are continuing to add capacity and becoming more efficient, whilst servicing the whole market.

For schemes where buy-out is now the right answer other options are increasing in scale. Clara Pensions has now completed their second deal with the Debenhams Retirement Scheme, which now takes on the benefits for over 20,000 members, and follows the Sears deal which completed in 2023.

More choice = more for clients to think about

After seven years of eight insurers in the bulk annuities market, the last six months has seen a “frantic” change in the insurer landscape with new entrants and consolidation. In reality, these are considered changes that have been in the pipeline for several years but no doubt the launch of new propositions has come at a time when choice can only be beneficial to schemes seeking to insure risks.

Who’s in?

M&G, writing business through its insurance business Prudential Assurance Company Ltd, (re)entered the market having completed two transactions in 2023 and recently announced a third transaction of c£300m in March 2024.

Royal London announced its entry to the market in March 2024 having completed two transactions for its own pension schemes and are actively quoting on new opportunities.

Canada Life began writing deferred transactions in 2023, including a shortly to be announced £80m full buy-in led by Barnett Waddingham (BW), so could be considered a new entrant to the full scheme market.

Utmost and potentially 2-3 other insurers are gearing up to enter the market.

What does this mean for schemes seeking to insure risks?

More price competition

Although these “new entrants” may be more selective on the cases they pursue in the early stages as they grow their teams and capacity, a greater number of insurers in the market can only lead to more quotations being delivered and increased price competition may be a result.

More choice but greater comfort needed on non-price factors

Trustees and sponsors will need greater reassurance in several areas when comparing a new entrant to an established bulk annuity provider.

Administration capability – member experience is a critical consideration in choosing an insurer. Whilst new entrants are likely to use third party administrators with significant bulk annuity experience from other roles, setting up and running payroll and member calculations is a significant task. Schemes will need advice on how administration services will be run and assurances around the service levels, which cannot necessarily be demonstrated based on past performance.

Commitment to the market, financial strength and depth of teams – given the long-term relationship between the insurer and the members/policyholders, credibility is important. Being one of the first schemes to transact with a new entrant will mean that trustees and sponsors will need comfort on the long-term commitment to the market from the wider business. The credibility and experience of the personnel involved is likely to be important in given trustees comfort.

Timeframes to moving to buyout – less established policies and practices mean the insurers need time to move schemes from buy-in to buyout. The ability to make this transition in a reasonable timeframe will be a commitment that insurers will need to make to manage stakeholders expectations. However, given the level of post-transaction data and admin work required, a 12-18 month timescales is likely to satisfy the majority of schemes.

Member communications – trustees will be conscious that they will need to explain the purchase of the bulk annuity policy and that future security will be provided by the insurer, rather than the employer covenant. The insurer regulatory regime and the cover provided by the Financial Services Compensation Scheme (FSCS) is important but the brand and market standing of the insurer will also be considered. Good communication is not a barrier to any insurer transacting with a scheme, but some will need to work harder than others.

Who’s out?

In March 2024, Lloyds Banking Group sold the £6bn in-force Scottish Widows annuity portfolio to Rothesay, which is expected to result in Scottish Widows formally exiting the bulk annuity market. Like the purchase of the Prudential £12bn back book in 2018, Rothesay will become responsible for these policyholders’ benefits following the normal Part VII transfer process.

Scottish Widows have historically been selective about the size and profile of schemes insured, so whilst the number of active participants in the market has reduced, the choice for schemes may not be impacted significantly and could be more than offset over time by the new entrants.

Inflow of capital to the bulk annuity market is expected to continue with potential M&A activity further supercharging the market. However, the limitation of human capital within the insurer, adviser and administration teams will continue to limit the volume of deals, by both size and number, at any given time.

New business and member experience - insurers will need to continue delivering both

"A big theme from the last twelve months is an increase in focus from our clients on how a decision to buy-in is explained to members, including the security of benefits and how accessible information will be during buy-in and after members become policyholders."

Insurers understand that this is critical and will in many cases, particularly with overfunded schemes, be as important to trustees as price when selecting a preferred insurer. Innovations such as member portals, automated quotations and access to data will help trustees get comfortable about the service their members will receive and make their role in communicating the transfer of obligations to an insurer easier. Put in the context of new entrants joining the market, these developments could act to push the bar higher to keep up with existing players. That said, new entrants do have the opportunity build their systems and processes for a member focussed buy-out market, rather than looking to adapt to changing demands.

Insurers are continuing to invest in people and systems in this area. The challenge could be taking the £50bn+ of transactions each year through to buy-out. This could lead to schemes being in the buy-in phase for longer than anticipated, incurring the costs of running on.

We believe there should be early engagement with advisers on what is important, and this is communicated to insurers as part of a selection process. These thorough preparations not only help get the best outcome for the buy-in transaction, but can also help schemes to be more nimble and transition to buy-out quickly. Please reach out to our team if you would like to know more.

|