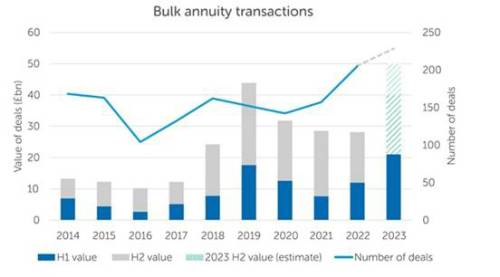

This is expected to bring the total 2023 deal value to well over £40bn, and the stage is set for 2023 to break records and exceed Barnett Waddingham’s previous £40bn prediction.

*Please note different shading colours between £40bn and £50bn deal volume prediction; the £40bn is more certain, and £50bn is a top-end estimate.

This heightened level of activity is driven by a stark increase in demand from schemes to insure their liabilities, caused by a notable improvement in scheme financing over the last 18 months. This improvement is underpinned by a combination of the steady progression of de-risking plans, unexpected funding improvements following strong investment performance, the increase in gilt yields over 2022, and from sponsor appetite to provide additional contributions. For most schemes, it’s a combination of these factors. All-in, Barnett Waddingham’s DB ‘End Gauge’ predicts that the average time for FTSE 350 schemes to reach end game – that is, buy-out or self-sufficiency – is now just 5.3 years, down from 10.2 years in September 2021.

The new normal for deal sizes?

Barnett Waddingham’s analysis of insurers’ data shows that transaction sizes have increased materially, reaching £220m on average in H1 2023 compared to £115m in H1 2018, despite interest rate changes dampening this trend. Interestingly, this trend for increasing deal size still holds even if the mega £6.5bn RSA transaction is excluded from the 2023 data. It estimates that around one third of FTSE 350 DB schemes are now fully funded on a buy-out basis, representing around £160bn of liabilities, and many schemes are taking steps to lock in those positive improvements. As a result, the stage is set for the increased demand for larger bulk annuity transactions to continue.

Rosie Fantom, Head of Bulk Annuities and Risk Transfer Partner at independent consultancy Barnett Waddingham, comments: “We're expecting to see a similar sized market in 2024, which has the potential to be dominated by a small number of exceptionally large trades. The challenge for insurers will be to balance the appeal of writing new business, whilst effectively serving the business that have already written.”

Given the pace of the market and significant deal sizes, there is a risk that smaller transactions get lost in the noise. Many insurers are segmenting the market and placing increasingly complex requirements on schemes ahead of committing to delivering a quotation; as such, smaller schemes are likely to struggle without adequate preparation and support.

Can the market keep up?

The intensity of the market requires experienced professionals to help everything run smoothly, and there is a risk that the capacity isn’t adequate across the industry to keep up with demand. In particular, pension administration teams are under intense pressure to run a high volume of data cleansing activities – and quickly. Similarly, insurers’ implementation and administration teams are grappling with the influx of deals, creating significant resource pressure. Combined, these risk creating a bottleneck for schemes focussed on winding up.

As a result, the market is adapting to drive efficiency and respond to heightened demand. All of the eight active insurers have now completed deals with non-pensioner liabilities and a new insurer, M&G, has publicly announced its first transactions. Other parties are building capabilities to join the market, but it will take time for new entrants to launch new propositions and, until then, Barnett Waddingham expects pressure to continue on the current market.

Chris Hawley, Risk Transfer Partner at Barnett Waddingham, comments: “Whilst the risk transfer market is busy, there are steps that schemes and sponsors can take to position themselves for a positive route to transaction. For example, being well prepared and having focussed objectives before approaching the market has never been more important. These steps will support the transaction process, but also make for a simpler and quicker route to buy-out with a higher degree of overall cost certainty.

“We’ve successfully placed every scheme we’ve taken to market in the last three years, including several small schemes under £2m. Regardless of scheme size, the most important factor in success is preparedness; quality of outcome must come first, and that means not rushing to market before you are ready.”

Rosie Fantom adds: “The risk transfer market is an exciting place to be this year. The volume and size of deals is higher than ever before, and that trend is only set to continue. As lead adviser to a significant portion of the market, including £3bn of the £21bn total transactions in H1 (containing a £900m buy-in with Thomas Cook, a £850m buy-in for the Arcadia schemes, and £1.1bn buy-in for the Chubb schemes) it’s a privilege to see first-hand the impact that well-considered cases can have in creating value for schemes, members and insurers alike.

“Critically, the improvements in scheme funding positions and move towards end game will help deliver certainty and security of outcomes for members. For all players in the market, ensuring positive results for people’s retirement savings is vital.”

|