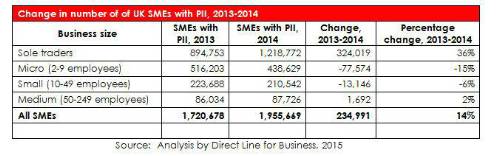

• Number of UK Small and Medium Sized Enterprises (SMEs) with Professional Indemnity Insurance (PII) grew by 235,000 between 2013 and 2014 – but two thirds have no cover at all

• Sole traders make up majority of new policies over the past year

• Direct Line for Business launches new Professional Indemnity insurance product

The analysis, conducted to support the launch of Direct Line for Business’s Professional Indemnity Insurance product, suggests that only 733,000 SMEs (14 per cent) are considering taking out PII in the next 12 months.

Despite the number of SMEs taking out PII growing by 235,000 – or 14 per cent – last year, without sole traders, there was a significant fall in the number of micro (-15 per cent) and small (minus six per cent) businesses taking out PII policies. Direct Line for Business warns that this is a dangerous prospect because businesses risk financial ruin without the appropriate PII cover.

Gary Holmes, Products Manager at Direct Line for Business, said: “The number of sole traders with PII has risen sharply over the past year, underlining the importance these entrepreneurs are placing on protecting themselves from the potential knock-on effect of a client suffering financial losses. That said, there are still a large number of businesses who are offering services or advice that don’t have the right cover in place, thus exposing their businesses to huge risks that could cripple their enterprises.

Without the right cover, providing incorrect advice or losing data could end in financial ruin for an SME.

Our recent introduction of Professional Indemnity Insurance not only allows us to offer a product our customers have been asking for, it also means Direct Line for Business has a comprehensive set of small business insurance products to cover our customers’ needs.”

When broken down by industry, Direct Line for Business’ analysis revealed that SMEs in the legal services industry were most likely to have PII, with 88 per cent of businesses taking out insurance. This is followed by financial services (59 per cent) and scientific, technical and engineering research (52 per cent). SMEs in transportation (12 per cent) and retail and wholesale (11 per cent) are the least likely to have PII cover.

Recent research revealed over 320,000 businesses had been affected by poor advice over the last 12 months2, underlining the importance for SMEs having suitable insurance cover in place.

Direct Line for Business Professional Indemnity Insurance provides cover to consultants, freelancers, contractors and other such services against claims made by their clients for financial loss, or reputational damage due to negligent advice, design or services. The policy covers the legal costs for defending the claim as well as any compensation paid out.

|