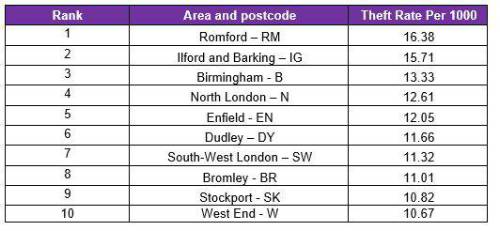

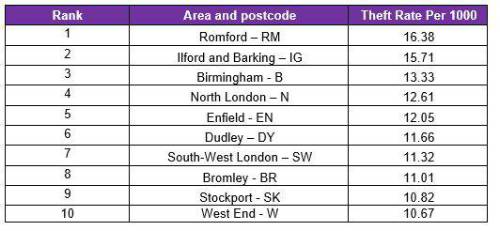

The UK’s leading price comparison analysed millions of car insurance enquiries made on its site between 20th July 2020 and 20th July 2021, to identify the areas with the highest and lowest rates of reported car theft claims within a five-year period. Romford (RM) tops the list for the second year running, with a car theft rate of 16.38 per 1000 insurance enquiries in 2021 - an increase from 15.74 in 20202. For its second consecutive year, Romford is followed closely by Ilford and Barking (IG – 15.71).

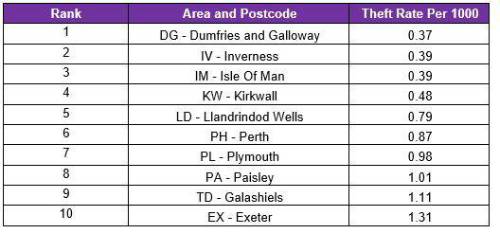

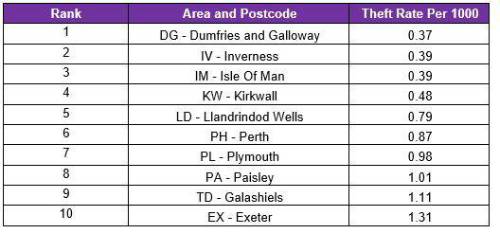

Dumfries and Galloway, located in Scotland’s Western Southern Uplands, has the lowest rate of reported car thefts at 0.37 per 1000 capita. Scottish locations dominate the ten safest areas for car theft, with Kirkwall (KW – 0.48), Perth (PH – 0.87), Paisley (PA – 1.01) and Galashiels (TD – 1.11) all taking top positions.

Postcode rankings – Top 10 most targeted areas for car theft

Postcode rankings – Top 10 safest areas for car theft

Postcode rankings – Top 10 safest areas for car theft

When it comes to age, drivers aged 30 to 39 are the most likely to report their car as stolen (8.78), whilst those aged 20 to 24 years face the least risk (4.09). This compares to 2020, where 40 to 49 year olds were most likely to face higher risk of car theft (8.33).

According to DVLA statistics, the Ford Fiesta was the vehicle most targeted by thieves in 2020 with 3,392 reported cases, followed by the Land Rover Range Rover (2,881) then the Volkswagen Golf (1,975).

MoneySuperMarket’s top tips to help Brits keep their cars safe and secure:

1. Make sure your car keys aren’t easily accessible, avoid leaving them near your front door and in sight of any potential opportunists.

2. Always check that your car is locked before you walk away – many assume their vehicle locks automatically and are putting themselves at risk of easy car theft.

3. If you’re able to, parking off road or in a garage can make it harder for criminals to steal your vehicle. Using a garage can help protect your car more and may also help you save money on your car insurance.

4. Many car thefts are opportunistic and aren’t planned, so make sure your car is fitted with an alarm and no valuables are left in sight. Where possible, don’t leave your vehicle running or unattended even if this is for a short period of time.

5. Getting windows made from security glass or Enhanced Protection Glazing, which are designed to prevent ‘smash and grab’ attacks, can protect you against damage to your vehicle.

6. Security measures such as tracking devices and steering wheel locks can act as good deterrents, minimising damage and increasing the chance of recovery.

7. If you have a keyless car, try purchasing a metal tin or protective pouch to store your keys in – this will help block criminals from using advanced methods such as relay technology to unlock your vehicle.

Praksha Patel-Shah, car insurance expert at MoneySuperMarket, commented: “Not only can where you live and park your car increase the likelihood of you experiencing car theft, but criminals are now becoming more inventive and sophisticated when it comes to modern vehicles, so extra preventions may be necessary.

“Our research shows that urban, built-up areas have the highest incidences of car theft, while more rural, remote areas tend to record fewer instances. Insurers do consider your location when providing you with a quote, so if you live in an area with a high theft rate, you might see this reflected in higher premiums. Regardless of your location, shopping around for a new car insurance policy can help reduce your costs significantly – in just a matter of minutes you could save up to £236 a year