“It's great to see a continuing increase in membership of workplace pension schemes with 64% of employees now in private workplace pensions.

In particular, it's good to see an increase in people saving for retirement in the 22 to 29 age group - up from 54% in 2014 to 61% in 2015. However work still needs to be done to encourage those aged 16 to 21, who are not automatically enrolled into workplace pension schemes to save for their future pension, which has remained static at only 12%.

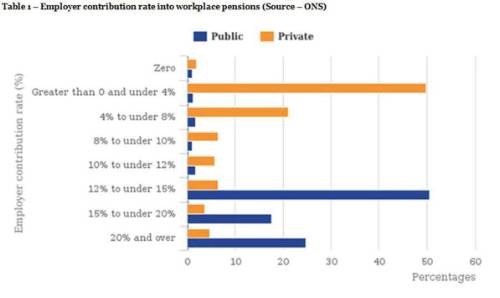

What is of real concern is the difference in employer contribution rates between public and private sector workers. In the public sector, where defined benefit pension schemes are prevalent, 87% of employees have a workplace pension and more than 92% enjoy an employer contribution rate of more than 12%. In the private sector however, contribution rates being paid mainly to defined contribution schemes are much lower.

For almost three quarters, (73%) of employees, employer contributions are less than 8%, a third lower than the public sector. And for more than half (51.9%) of employees the employer contribution is between zero and 4%, two thirds lower than the public sector.

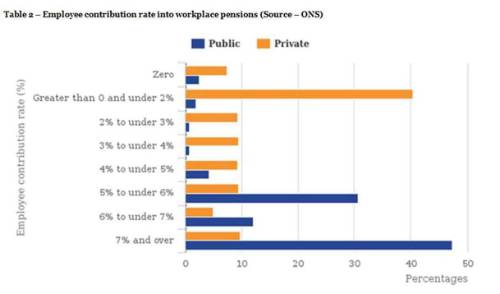

Employee contributions follow a similar pattern with more than 47% of employees in the public sector making a contribution of 7% or more of their pensionable earnings, compared with only 9.8% of employees in the private sector. The vast majority, more than 75% of private sector employees are contributing less than 5% of their pensionable earnings into their workplace pensions. So it looks like most employers and employees in the private sector are making just the minimum auto-enrolment contributions.

It is vitally important for members of workplace pensions to understand that to secure a decent income in retirement they potentially need to make contributions at a much higher level than they currently do. They need to regularly review the amount that they are contributing, otherwise the income they are able to secure is likely to be not enough for the lifestyle they hoped and they may well need to continue to work much longer than anticipated.

The minimum level of contributions that must be made into an auto-enrolled workplace pension scheme is due to increase from 2% to 5% in 2018 and then to 8% by 2019. These levels will still be woefully inadequate for many to secure the income they need. Royal London would seriously recommend that people review the contributions they can make now and where possible increase their pension contributions so they are able to retire with a good standard of living.”

|