The study of 2,000 people found that while a quarter of UK adults have a life insurance policy (26%), just 6% have critical illness cover and 4% have income protection insurance.

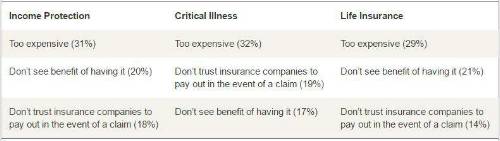

For each product, the same barrier is top – price – with nearly one in three who don’t have life insurance, critical illness cover or income protection saying they think the products are too expensive (29%, 32% and 31% respectively). Analysis of premiums Royal London customers pay reveals the average life insurance premium is £21.28 per month for over £120,000 of cover and the average critical illness cover premium is £30.58 per month for over £71,500 of cover.1

The second most common barrier was people not seeing the benefit of the product. Yet almost two fifths (38%) say it is important to ensure that their family and dependants are looked after financially should they die and half (47%) agree that life insurance is essential for anyone with a mortgage or dependents. This shows that with better education, from the industry and advisers, more people could be better protected.

The third barrier is not trusting insurance companies to pay out in event of the claim. Yet the most recent industry figures show insurers pay out in 97.2% of all claims.2

Top reasons for not having insurance

Debbie Kennedy, Group Head of Protection Strategy at Royal London said: “State of the Protection Nation reveals that just one in 10 people in the UK think income protection is necessary. Yet they also want to protect themselves and their loved ones should hard times hit. There is clearly more we can do to raise awareness of the positive impact insurance can have on improving the financial resilience of people.”

The research reveals that more people see a need for the products than actually have them, suggesting that with greater action on the barriers the UK could be better protected. While one in 10 (9%) say they see the need for income protection just 4% hold it and while 12% say they see the need for critical illness cover, just 6% hold it. For life insurance, however, take up matches perceived need, where 27% see the need and 26% hold it.

Those with children under 18 are much more likely to believe that all three types of product are needed, in particular critical illness cover (21% compared to 9% who don’t have children).

Royal London also found more work needs to be done to help people understand what could happen to them during their working life. According to the research, respondents were more likely to think they will die (22%) within their working life than be made redundant (15%), contract a serious health condition or illness (15%), go on sick leave for three months or more (11%) or have an accident preventing work (9%). Yet a quarter (25%) of those polled had been made redundant or lost their job at some point, whilst one in seven (15%) have been off sick for three months or more or been diagnosed with a serious health condition or illness.

Debbie Kennedy said: “Our research shows that people are far more likely to think they will die during their working life than be hit by redundancy or critical illness, yet statistically it is far less likely. Official statistics show that more than four times as many people were made redundant than died early 3 – showing the importance of having cover beyond life insurance.”

The State of the Protection Nation research has been conducted, in part, to benchmark consumer and adviser confidence in protection products and providers over time. Looking at awareness, take up and confidence, it finds an initial consumer confidence ranking of 53.2, out of a maximum score of 100. Looking at tendency to recommend products and confidence in the future of the market, it finds an initial adviser confidence score of 60.75.

|