Surveying its membership in February this year, the Society of Pension Professionals sought to assess sentiment across the industry on what members thought the changes should and will be and when they thought changes should and will take effect.

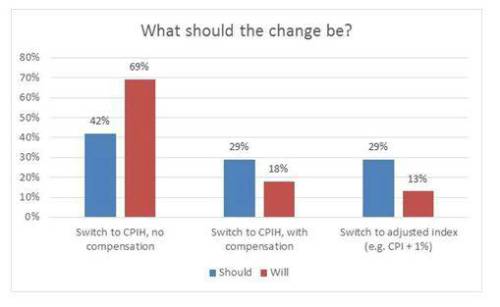

The industry is split over what should happen, but the most common view is that RPI reform should simply switch to CPIH with no compensation. Over a quarter (29%) think that there should be a switch to CPIH with compensation, while the same number (29%) think that there should be a switch to an adjusted index (e.g. CPI + 1%). 42% of respondents think that there should be a switch to CPIH with no compensation.

In contrast, over two thirds (69%) believe that the change will ultimately go ahead as a straightforward switch to CPIH.

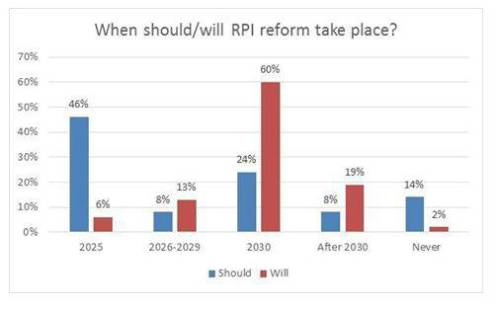

Nearly half of respondents (46%) think that reform should take place by 2025, while a majority (60%) believe that it actually won’t happen until 2030. A further 21% think the changes will come into force after 2030 or not at all.

The survey also asked respondents to rate on a scale of one to five some of the most serious issues that are likely to impact as a result of the changes. The impact on funding positions and a fall in asset values was cited as the greatest concern with a weighted average rating of 3.40, followed by a reduction in members’ benefits (3.30) and then difficulty in hedging effectively (3.18). Practical implications e.g. pressures on admin and communications, were of least concern to pension professionals (2.70).

Paul McGlone, President of the Society of Pension Professionals, said: “What is clear from our survey is that there still a lack of consensus on the most suitable replacement for RPI or the timescales for implementing change. This isn't surprising given the very different impacts that the change has on schemes, sponsors and members.

“The difference between expectations of what should and will happen is interesting, with our membership expecting the change to be more penal then they would like, but to come into force later then they think it should.

“Hopefully the imminent consultation, due to be announced in the Budget, will allow the industry to coalesce around a suitable approach. Failure to implement the right reform in a timely fashion could be very damaging to UK pension schemes and their members. We would encourage all corners of the industry to engage with the consultation when it launches.”

|