One in five people taking a ‘rule of thumb’ yearly retirement income of 4% will run out of money in 30 years

Report highlights the importance of personalised financial advice regarding income rates

Aegon sets out a new sliding scale when considering sustainable income level, from 1.7% to 3.6%

Over half a million people have opted for flexible payments from pensions - worth £9.2bn[1] of retirement income - since the pension freedoms launched in April 2015. However, according to a new report2 from Aegon, and actuarial firm EValue, economic conditions as well as improvements in life expectancy are casting doubt over the historic rules of thumb designed to help those in drawdown determine a ‘sustainable’ retirement income level.

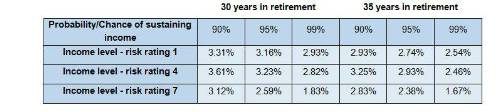

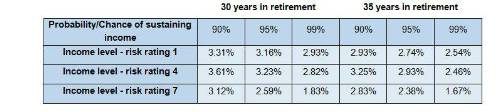

The report instead sets out a sliding scale, from 1.7% to 3.6% depending on the risk profile and time period, as a starting point for considering the appropriate level of retirement income, and highlights the key role of advisers in determining a personalised income rate for their individual clients.

The ‘4% rule’, developed by US adviser William Bengen in 1994, has often been turned to as a rule of thumb for determining a sustainable level of retirement income. However, Aegon’s research found that in today’s economic climate, a 65 year old entering drawdown in a low risk portfolio, taking 4% of the initial amount each year, has a one in five chance of running out of money within 30 years.

Since Bengen, some experts have provided updated rules of thumb, but all tend to aim for a single universal percentage. Aegon commissioned EValue to conduct actuarial analysis and develop a guide to sustainable income levels for the millions of people in the UK entering retirement in the coming years. The report suggests income rates should instead be based on a sliding scale from 1.7% to 3.6%, depending on an individual’s life expectancy, investment strategy and willingness to accept a small chance of running out of money.

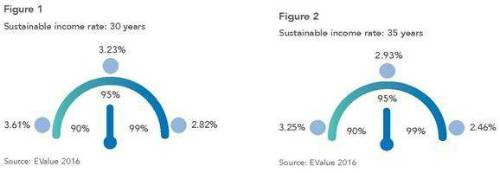

Aegon’s indicative guide to sustainable income levels: (sliding scale according to different risk profiles from EValue, where risk rating 1 is low risk and risk rating 7 is high risk, time horizon’s and willingness to accept a small chance of running out of money.)

Today’s analysis also provides advisers with an opportunity to engage with the increasing numbers of people approaching retirement who are considering drawdown but unsure how to structure their income. There’s a clear message for this group: rules of thumb can’t be relied upon when looking at individual circumstances and a more tailored approach, which takes into account broader financial planning considerations, is likely to be much more successful.

Steven Cameron, Pensions Director at Aegon, said: “Planning a retirement income to last a lifetime is too important and complex to be boiled down to a simple rule of thumb. The 4% ‘sustainable income’ rule was developed in the US in the 90s, at a time when interest rates were significantly higher. More recent studies in the US and UK have brought this figure down, but any attempt to come up with a single number will never work across a wide range of clients with different life expectancies, risk appetites, and capacity for loss. Advisers will be well aware of the dangers that rules of thumb pose but we hope our sliding scale provides an additional insight on which they can build tailored income rates for different clients.

“People that have assets to fall back on outside of their pension may be more comfortable with a higher probability of their pot running dry in retirement, while those relying on it as their sole income will want more certainty. Life expectancy is also a key factor with current health status, lifestyle, family history and advances in medical treatments all playing a part in the time horizon a client should be planning over. Advisers need to consider all of these factors to recommend a sustainable income rate personalised to individual circumstances.

“Of course, income levels should be reviewed regularly to reflect changes in both personal circumstances and the wider economic environment. Advisers have the opportunity to add true value both at and in retirement, protecting and enhancing their client’s outcomes.”

Mark Grimes, Product Director at technology provider EValue, comments: “This has been a really interesting exercise in testing how an assumption like taking 4% retirement income for life will work in practice. The research is driven from our economic forecasting tools and localises the 4% rule to the UK market – a good thing for advisers and customers alike. Importantly, it challenges all of us to broaden our thinking beyond the more traditional retirement income models in a much changed pension landscape.”

|