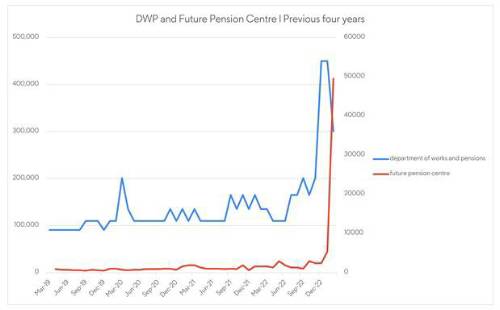

Internet searches for the Department of Work and Pensions surged 123% in February, compared to the same time last year while those for the Future Pension Centre jumped nearly 3,000%, according to analysis from Standard Life, part of Phoenix Group.

Standard Life’s Search Radar found there were 301,000 searches for the DWP in February which were most likely driven by growing awareness of an upcoming deadline for people to fill gaps in their National Insurance record through voluntary contributions. In February last year there were just 135,000 searches by contrast.

The jump in searches for the Future Pension Centre, the government service which oversees state pension forecasts, jumped from around 1,600 last February to 49,500 this year – an increase of nearly 3,000%. The surge in interest ultimately led to the DWP extending the deadline to top up state from April 5th to July 31st.

About the NI top-scheme

Under normal rules, you can only fill gaps in your NI record from the last six years. But if you reached or will reach State Pension age after 6 April 2016, you currently have the chance to plug gaps in your NI record going back to 2006. In simple terms, for those with gaps in their NI record, there’s potentially an opportunity to pay around £800 to cover a full year of contributions which would lead an additional £275 per year from their state pension1. For those who live for 20 years in retirement, the payment would create £5,500 of additional state pension income.

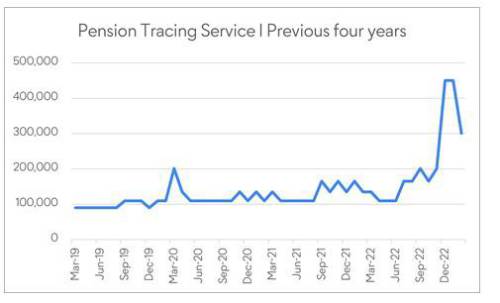

Jump in pension tracing searches

Searches for ‘pension tracing service’ also rose 82% in the same period and reached 40,500 in February. Pension tracing and consolidation has been in the spotlight in the last few months. There was also a spike in pension tracing searches in July, with around 33,000 searches carried out, compared to fewer than 10,000 conducted in most of the months in 2022. This was likely driven by awareness campaigns noting the Unclaimed Assets Register shutting in August, which highlighted that that £50bn of assets lay unclaimed in the UK, the vast majority of which – £37bn2 – was thought to be locked away in old pensions. A smaller spike in October could be attributed to activity marking National Pension Tracing Day that month.

Dean Butler, Managing Director for Customer at Standard Life, comments: “A growing realisation that a special window to top-up state pension payments was closing drove a huge volume of searches in February. The volumes were such that the government extended its initial deadline from April to July in order to let people take advantage of a potentially very significant boost to their retirement incomes.

“There are billions of unclaimed, dormant or lost pension plans in the UK and with the pensions dashboard still some way from landing, it looks as though significant numbers of people are taking matters into their own hands and tracking down lost pots.”

|