The external market (where people exercise their right to shop around, often called the open market option) market was £847m in Q1, up from £578m in Q4 22 and £463m in Q1 22. This is the largest reported OMO market since Q2 14.

The OMO represented 71.5% of the total market in Q1 by premium and 64% by count (basically for every £100 of pension savings used to purchase an annuity, over £70 was invested in an annuity from a provider in the external, OMO market). This is the highest ever reported.

The average OMO premium increased to £81.6k in Q1 23, up from £71.7k in Q4 22 and £64.5k in Q1 22. This is the highest ever recorded.

Commenting on quarterly industry annuity sales figures from the Association of British Insurers, Stephen Lowe, group communications director at retirement specialist Just Group, said: “There is much to like in the ABI’s figures beyond the increase in quarterly sales.

“It’s encouraging to see nearly two-thirds of retirees used their right to shop around and to switch away from their existing pension savings provider to a more competitive provider of annuities, although that still shows around a third are likely to be missing out on extra income.

“Shopping around is particularly important because it’s the closest thing to ‘free money’ in the retirement world and staying loyal to a provider can cost you dearly.”

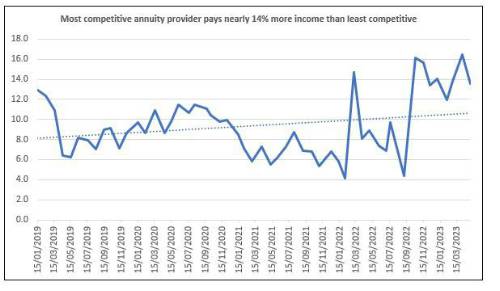

“The gap between the top and bottom providers has widened to the point that a healthy 65-year-old can secure nearly 14% more annual income by securing the best instead of the worst rate, and potentially an even higher income depending on lifestyle factors and medical history.

“Annuity brokers and financial advisers can help people find the best deals by asking the right questions and having access to live rates from different providers. The ABI’s figures suggest the average pension used to buy an annuity was nearly £74,000 but even far smaller amounts than this are significant and justify seeking professional help.

“Beyond finding the best rate, brokers and advisers can help retirees choose the best ‘shape’ in terms of a spouse’s pension, death benefits and inflation-protection options which, as today’s figures show, becomes more important at a time of sharply rising costs.

“Annuities inhabit a unique space in the retirement world. They are the only solution that removes both investment and longevity risk. Most retirees will want the peace of mind of having a level of secure income to pay the bills – that’s true pension freedom.”

|