Many of those surveyed referred to the amount of information online and the challenges of identifying sound sources. The volume of opinion led to feelings of being overwhelmed, and therefore paralysis and inertia, with savings kept in cash.

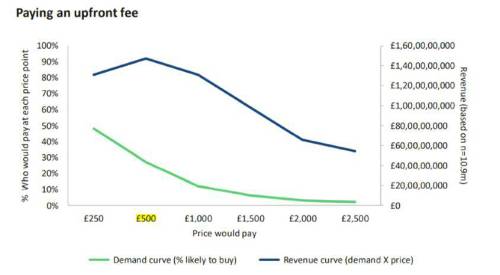

However, the research also found significant numbers willing to save or invest and even pay for support if it made saving and investment decisions easier for them. EY Seren asked if potential clients would be willing to pay a fee for such services, with a significant 48% willing to pay an upfront fee of £250 and 27% comfortable with spending £500. Additionally, an average of 63% were interested in the six propositions for personalised guidance or information tested in the research.

According to the findings, customers see high-quality, full financial advice as expensive but valuable. A common perception was that paid-for financial support was 'not for someone like me', but for those with significant sums or with a significant decision to make such as buying their first property. One respondent noted: "I’ve always thought in 10 years when my salary is higher, then I would speak to someone, it would cost money, but you’d recoup the money."

There is a vast pool of potential new savers and investors willing to pay for support services, but the industry needs to respond by creating different propositions at different stages of the customer journey. EY Seren’s research supports the thesis that personalised guidance and support would bring more consumers with small portfolios into the market, who would then access fully fledged advice when they accrued more capital.

The end-goal of TISA’s collaboration with the FCA and providers would be to see amendments made to the regulations around Advice, to allow firms to offer access to various forms of support and guidance services, from fully-fledged, high-quality advice to personalised guidance to more helpful information. The industry could then help individuals understand which support service would be most valuable to them at various points in their life: information, personalised guidance or advice.

Prakash Chandramohan, Strategic Policy Director at TISA said: “The FCA, Government and Industry need to build a sustainable framework and create a future where consumers have access to a wider range of support initiatives to make saving & investment decisions - from fully-fledged, high-quality advice to personalised guidance to more helpful information.

“This would help millions more consumers get the type of support they need. It would bring a substantial new customer base to financial services providers, including advisers. Personalised support and guidance would give people greater confidence and mean better outcomes for the many. In turn, it would help highlight to people when they need advice. The industry, the FCA and TISA are working hard to create a framework which will benefit consumers, advisers and providers, and I would like to invite further views from the community as the consultation continues.”

Julie Green, Innovation and Digital Director at Aviva said:?“This study presents an opportunity to our industry and the financial advice community. We know that millions of customers who would benefit from advice or guidance are not getting the support they need to make financial decisions around savings and investment. This is a growing concern and will impact future outcomes for many households.

“Full financial advice is and will always remain the gold standard when it comes to supporting customers making complex decisions about investments and retirement, but we believe there is an opportunity to increase the accessibility of support to a wider group of customers by providing a range of options including Personalised Guidance and Simplified Advice, improving the financial well-being of many people. This research provides the customer insight to support that view, and we look forward to working with TISA, the industry, and the FCA to explore these options and better serve our customers.”

|