The purchasing power of cash-based savings has been severely impacted since inflation began its steady creep upwards and is at risk of deteriorating further. The new analysis from Standard Life, part of Phoenix Group, examines the impact of prolonged periods of high inflation on people’s hard-earned money.

The UK has now seen seven consecutive months of double-digit price rises, and while inflation rates are forecast to fall sharply towards the end of this year it’s now two years that consumers have had to contend with rising household energy bills, escalated cost of food and transport as well as the decreasing purchasing power of their cash. The latest inflation figures are due to be published this week, and will be watched closely to determine whether rates are likely to fall as sharply as expected.

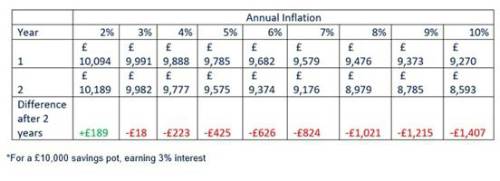

New analysis from Standard Life highlights the extent to which savings can be affected by inflation, and in particular over a prolonged period of rising rates. For example, £10,000 in savings earning 3% in interest would drop in buying power to just £8,593 after a two-year period of 10% inflation. While interest rates have risen over the past year the returns on easy-access savings accounts, averaging about 3%, are a long way from keeping pace with price increases.

In contrast, if inflation was 2%, the Bank of England’s target level, after two years its purchasing power would be £10,189. Savers have consequently already lost a significant amount of spending power since this period began and are at risk of losing out further if the situation continues beyond expectation.

Dean Butler, Managing Director for Retail at Standard Life said: “Interest rates are no match for inflation with the pound in the pocket worth less due to the effects of sustained rising prices, as fuel, energy, and food costs in particular surge. While the Bank of England is predicting inflation rates have peaked and will fall sharply over the coming months, inflation is proving more stubborn than previously predicted and this not only affects your regular income, but hard-earned cash-based savings have been and will continue to be impacted too as their purchasing power is reduced. It’s therefore especially important to make sure that the money you have saved and can save is working as hard as it can for you and your future.”

As high inflation continues to bite, Standard Life offers tips to help you make your savings work harder:

1. Revisit your financial goals - As prices continue to increase, you might find that your current financial goals could take longer to reach than originally planned, or they might need to be adjusted. So now could be a prime time to revisit your plans and consider if they need to change.

2. Have a direct debit detox – Many of us rack up memberships and subscriptions that we could probably live without, so have a think whether you could cancel them or shop around for a better deal. You might be surprised at how much money you could save.

3. Prioritise your spending – Whilst times are tough, it’s worth seeing if you can put off purchases you’d planned for a while longer. If it’s not essential, you might be better waiting until you’re confident that making that purchase now won’t impact your standard of living. However, if you’ve been thinking about making a big purchase, such as a car or a required home improvement and you have the money to do so, you might find you’d be better off going ahead now rather than waiting until later when prices could be even higher and the pound in your pocket worth less – it could save you money in the long run.

4. Try to clear any outstanding debt – Interest rates have risen as the Bank of England tries to control rampant inflation, and the base rate is now the highest it’s been since the 2008 financial crash. If you have any variable rate debt, you might find that your regular payments have gone up as a result. So, it’s best to review debt arrangements as a priority, making sure you are reducing interest being paid as much as possible.

5. Make the most of tax efficient savings - You might find there are different benefits you could get depending on how you save your money, which could make the most of what you’ve got. It’s worth bearing in mind that you get tax benefits on pension payments, effectively meaning it costs less to save more into a pension plan. So even if you’re focussed on short-term finances at the moment, it’s important to continue contributing to your pension: time in market is one of the most important factors in investing, and if you choose to stop contributing you may miss out on valuable contributions from your employer. Although remember that you can’t access your pension savings until you’re aged 55 (rising to 57 in 2028). If you want to access your money before 55, Stocks & Shares ISAs are a great, tax-efficient way to save for medium or long-term goals without having to tie up your money, but remember the value of shares can fall as well as rise. Or you could consider a Cash ISA for shorter-term goals like rainy day funds- but, of course, be mindful of the impact of inflation on the value of these.

6. Consider making investments - If you want to give your savings the opportunity to grow in line with the rate of inflation (and, importantly, stand a chance of beating it) then one of the best ways to do this is to invest over the medium to long term, which is generally five years or more. Your pension plan, Stocks & Shares Individual Savings Accounts (ISAs) and any other investments will offer investment options that have the potential to grow your money over the medium to long term. For more information on this, you can speak to your bank or provider, or visit the government’s free Money Helper service.

|