Keeping up good lockdown savings habits could see UK savers boost their pension pot by £83k

• 6 months on from the start of lockdown (23 March), savers in the UK should take stock of their savings and investments

• During lockdown, Aegon research found those able to save more were putting away an extra £197 a month on average

• Even if half that was paid in future into a pension, a 30 year old could be £83k better off in retirement as a result

• With bank deposits offering returns as low as 0.1%, it’s important to consider investing excess funds to get a better return

Steven Cameron, Pensions Director at Aegon, said: “The economic toll of Coronavirus has been drastic for many, but for others there’s been a positive impact on saving. With less money being spent on the daily commute, leisure activities and holidays, our research found many had been able to increase their monthly savings by an average of £197. For those in this fortunate position, after 6 months of extra ‘lockdown’ cash being added to their bank balance, now’s the time to review future savings and investments to get a better long term return.

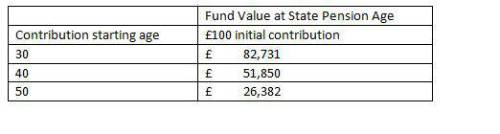

“It’s worth taking stock of savings to make sure you’re not sitting on excess cash that’s earning little or no interest. If you’ve no immediate need for any excess cash, thinking about the long term and either ISAs or pension saving can make a significant difference. Having got into the habit of saving more, considering turning part of this into additional pension contributions can make a huge difference to your pension pot. And the younger you start, the bigger the difference. If you were saving the average extra of £197 a month, putting half of that or £100 extra a month towards a pension, could mean someone age 30 would benefit from a £83,000 bigger pension as a result. Those in their 40s or 50s could also see a big difference. And as an extra bonus, tax relief means that £100 would cost you £80 from take home pay if you’re a basic rate taxpayer.

“In these uncertain times, many have no option but to focus on today’s challenges. But where possible, putting more aside into savings can help people build up greater financial security for their futures. It can pay to seek financial advice.”

*The figures assume investments growth at 4.25% after charges and contribution growth of 3% per year. Fund values are in today’s money term taking into account 2% inflation rate. Assumed state pension age for 30 and 40 year old is 68 and assumed state pension age for a 50 year old is 67.

|