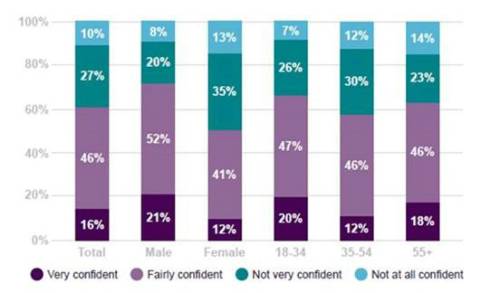

As we reach the milestone of 10 years of Automatic Enrolment, a new report, ‘The Future of Auto Enrolment’, from mutual life and pensions company, Royal London, reveals that only a minority of UK employees (16%) are very confident that the amount they are currently saving is sufficient for retirement. A further 46% are fairly confident, however this leaves a significant proportion of workers (37%) that are not confident.

Just a minority of UK workers feel very confident about their retirement prospects based on their current savings level – a reflection of the current clustering around minimum contribution levels

Sleepwalking into retirement

However, even then, confidence may be based on hope rather than expectation. Taking a closer look at the amount employees are currently setting aside for their retirement, two fifths (43%) of those that are confident they will have a secure income for the duration of their retirement are currently saving 5% or less of their annual gross income. It can be difficult to know how much should be saved into a pension, but the earlier an individual starts saving, the easier it is.

To date, auto enrolment has been a big success story, normalising workplace pension saving. It has changed the way millions of individuals save because of the dynamic of ‘opt out’, rather than the ‘opt in’ route of its predecessor, stakeholder pensions. The scheme’s success is down to the power of apathy, but that indifference also leads to a lack of real engagement, so much so that many simply take a ‘set and forget’ approach. The result leaves many unsure of how much they’re currently saving - 15% don’t know how much they and their employer are collectively contributing to their workplace pension. 40% of workers have little or no idea how much they need to save for retirement.

One in five (20%) workers also admit to having never checked their pension savings. The danger is that without establishing a plan, it makes it difficult to know how much they’ll need to save to achieve the lifestyle they aspire to in retirement.

While now might not be the right time, without a plan to increase pension savings levels in the future, today’s cost of living crisis could be repeated in retirement, with millions of people under-saved for their later years.

Jamie Jenkins, Director of Policy & External Affairs at Royal London, said: While the priority for people at the moment is dealing with the current cost of living challenges, the crisis we have today provides a useful insight into what retirement might look like if a generation of people have not saved enough. It’s therefore crucial that we set out a clear plan to raise retirement saving to more adequate levels in future.

“Saving for later life through your employer may be embedded into the DNA of the UK pensions system, thanks to automatic enrolment, but we need to be realistic about setting the right level of saving to achieve the retirement people aspire to.”

“For most people, saving at the minimum of around 8% of their salary won’t be enough to give them the kind of retirement that they want. Older workers often look back on their working life with regret that they didn’t take more responsibility for their financial future sooner – either starting saving earlier or putting a bit more away than they did.”

“Starting to save for retirement as early as possible gives you the best chance of building up a bigger pot over as long a period as possible.”

|