|

|

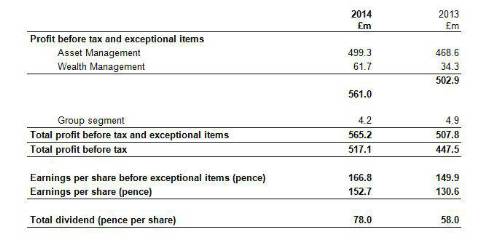

Profit before tax and exceptional items up 11 per cent. to £565.2 million** (2013: £507.8 million) Profit before tax up 16 per cent. to £517.1 million (2013: £447.5 million) Earnings per share up 17 per cent. to 152.7 pence (2013: 130.6 pence) 78 per cent. of assets under management outperforming over three years*** Net inflows £24.8 billion (2013: £7.9 billion) Assets under management up 14 per cent. to £300.0 billion (2013: £262.9 billion) Full-year dividend up 34 per cent. to 78.0 pence per share (2013: 58.0 pence) |

Michael Dobson, Chief Executive, commented: “2014 was a record year for Schroders. Profit before tax and exceptional items was up 11 per cent. to £565.2 million and assets under management were up 14 per cent. to £300.0 billion. We generated net new business of £24.8 billion from clients around the world on the back of competitive investment performance across a broad product range and strong distribution.

The Board is recommending a final dividend of 54.0 pence per share bringing the total dividend for the year to 78.0 pence per share (2013: 58.0 pence), an increase of 34 per cent.

We believe our focus on building a diversified business across a broad range of investment strategies will continue to deliver value for clients and shareholders over the long term.”

Management Statement 2014 was a strong year for Schroders with high levels of net new business and increased profit, as we benefited from the diversity of our business across a broad range of asset classes, client channels and regions. Net revenue increased by 9 per cent. to £1,531.2 million (2013: £1,407.6 million) and profit before tax and exceptional items increased by 11 per cent. to £565.2 million (2013: £507.8 million). We won net new business of £24.8 billion (2013: £7.9 billion) and assets under management were up 14 per cent. to £300.0 billion (2013: £262.9 billion).

Asset Management

Asset Management net revenue increased 5 per cent. to £1,303.5 million (2013: £1,247.2 million) despite lower performance fees of £34.2 million compared to an unusually high level of performance fees in 2013 at £80.2 million. Net revenue margins, excluding performance fees, were marginally down at 52 basis points (2013: 53 basis points) which was caused by business mix changes during the year. Profit before tax and exceptional items was up 7 per cent. at £499.3 million (2013: £468.6 million).

Exceptional items of £17.6 million (2013: £13.5 million) related principally to the amortisation of the value of client relationships acquired with Cazenove Capital and STW and integration costs arising from those two acquisitions.

Our depth of investment talent in the UK and internationally across portfolio management and research, disciplined investment processes and a programme of active engagement with the companies in which we invest, led to competitive investment performance with 78 per cent. of assets under management outperforming benchmark or peer group over three years to the end of 2014. We generated £24.3 billion (2013: £9.4 billion) of net new business during the year as a result of good investment performance, a broad product range across asset classes and a proven distribution capability. In addition to £13.3 billion of net inflows in the UK we saw the strength of our international network with net inflows of £6.0 billion in continental Europe and £5.3 billion in Asia Pacific. By asset class, we had net inflows of £16.9 billion in Multi-asset, £4.7 billion in Fixed Income and £4.5 billion in Equities, with net outflows in Commodities stemming from the challenging environment in this asset class.

In Institutional, we won net new business of £17.6 billion (2013: £4.6 billion), including a £12.0 billion mandate in Multi-asset and Equities from Friends Life. Assets under management in Institutional ended the year at £171.1 billion (2013: £144.3 billion).

We also had a strong year in Intermediary with net inflows of £6.7 billion (2013: £4.8 billion) and high levels of demand in continental Europe and Asia Pacific. Income products continued to be an important theme behind investor demand. Assets under management in Intermediary ended the year at £97.8 billion (2013: £88.5 billion).

Wealth Management

Our Wealth Management business generated significantly higher revenues and profit in 2014, benefiting from a full year of contribution from Cazenove Capital. Net revenue increased 42 per cent. to £213.5 million (2013: £150.0 million), including performance fees of £2.9 million (2013: £0.4 million) and a release of £6.1 million of loan loss provisions. Profit before tax and exceptional items was up 80 per cent. to £61.7 million (2013: £34.3 million). Exceptional items of £20.4 million (2013: £30.9 million) related principally to integration costs and the amortisation of the value of client relationships acquired with Cazenove Capital.

Our focus in 2014 was on ensuring a successful integration of Cazenove Capital with minimal disruption to clients, but we nevertheless generated net inflows of £0.5 billion (2013: net outflows £1.5 billion) as the strength of our wealth management proposition was widely recognised. Assets under management ended the year at £31.1 billion (2013: £30.1 billion).

Group

The Group segment comprises returns on investment capital and seed capital deployed in building a track record in new investment strategies, and central costs. Profit before tax and exceptional items was £4.2 million (2013: £4.9 million). Exceptional items of £10.1 million (2013: £15.9 million) comprised costs relating to the acquisitions of Cazenove Capital and STW.

Shareholders’ equity at the end of 2014 was £2.5 billion (2013: £2.3 billion).

Dividend

Our policy is to increase dividends progressively, in line with the trend in profitability, and to target a dividend payout ratio of 45 to 50 per cent. In light of the results achieved in 2014, the Board will recommend to shareholders at the Annual General Meeting an increase in the final dividend of 29 per cent., taking the final dividend to 54.0 pence (2013: 42.0 pence). This will bring the total dividend for the year to 78.0 pence (2013: 58.0 pence), an increase of 34 per cent. The final dividend will be paid on 6 May 2015 to shareholders on the register at 27 March 2015.

Outlook

In an extraordinarily low interest rate environment financial markets have been resilient despite numerous macro-economic uncertainties. This may continue for some time although we expect to see greater volatility in markets and therefore in investor demand in 2015.

Our focus remains on the long term where we see a wide range of growth opportunities in the UK and internationally. We believe that our strategy of building a business which is highly diversified across different clients, asset classes and regions will continue to deliver value for clients and shareholders.

Contacts:

Investors Emily Koya Head of Investor Relations +44 (0) 20 7658 2718 emily.koya@schroders.com

Press

Beth Saint Head of Communications +44 (0) 20 7658 6168 beth.saint@schroders.com Anita Scott Brunswick +44 (0) 20 7404 5959 schroders@brunswickgroup.com |

|

|

|

| Take the lead client-facing projects ... | ||

| Various locations - Negotiable | ||

| Choose Life! Choose a major global co... | ||

| Various locations - Negotiable | ||

| Actuarial skillset? Apply now for Snr... | ||

| South East / hybrid with travel requirements - Negotiable | ||

| Financial Risk Leader - ALM Oversight | ||

| Flex / hybrid - Negotiable | ||

| Be the very model of a modern Capital... | ||

| London - Negotiable | ||

| Pensions Actuary seeking a high-impac... | ||

| London or Scotland / hybrid 3dpw office-based - Negotiable | ||

| Great opportunity for Pensions Actuar... | ||

| London or Scotland / hybrid 3dpw office-based - Negotiable | ||

| Responsible Investing Manager - Clima... | ||

| London/Hybrid - Negotiable | ||

| Quant Strategist | ||

| London/Hybrid - Negotiable | ||

| Multiple remote longevity contracts | ||

| Fully remote - Negotiable | ||

| Multiple remote inflation hedging con... | ||

| Fully remote - Negotiable | ||

| Play a vital role in shaping a new He... | ||

| London or Scotland / hybrid 50/50 - Negotiable | ||

| Support the Longevity team of a globa... | ||

| London / hybrid 2 days p/w office-based - Negotiable | ||

| Delve into financial risk within a ma... | ||

| Wales / South West / hybrid 1dpw office-based - Negotiable | ||

| Project-based Life Pricing Actuarial ... | ||

| South West / hybrid 2 dpw office-based - Negotiable | ||

| Pricing Actuary | ||

| London - £120,000 Per Annum | ||

| Develop your career in motor pricing | ||

| UK-wide / hybrid 2 dpm office-based - Negotiable | ||

| Experience real career growth in home... | ||

| UK-wide / hybrid 2 dpm office-based - Negotiable | ||

| Be at the cutting edge of technical p... | ||

| UK-wide / hybrid 2 dpm office-based - Negotiable | ||

| Use your passion for innovation and t... | ||

| London / hybrid 2 days p/w office-based - Negotiable | ||

Be the first to contribute to our definitive actuarial reference forum. Built by actuaries for actuaries.