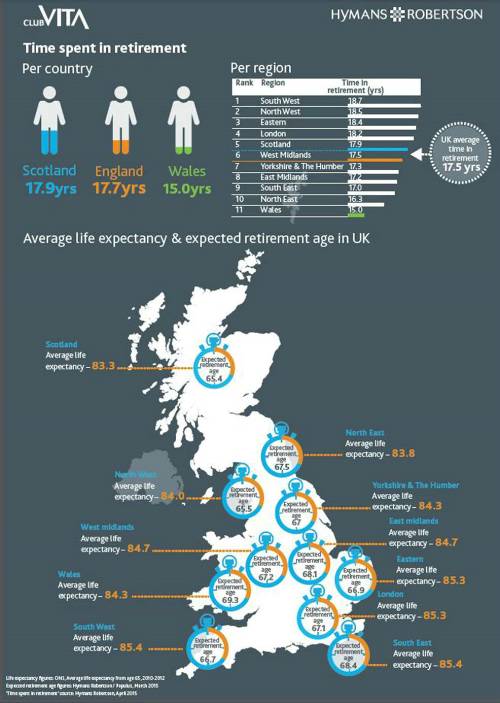

Research released today by Club Vita, the only company dedicated to providing longevity services to occupational pension schemes, shows how long on average individuals within the regions of Great Britain are likely to spend in retirement. These figures are based on life expectancy at age 65 and the age at which individuals expect to retire by region*. See the graphic below.

Commenting, Douglas Anderson, Partner at Hymans Robertson, said:

“Undoubtedly people’s expectations about when they will retire will be driven by a mix of factors: including job satisfaction, affordability, aspiration and perceived life expectancy. It will be interesting to see what effect the pension freedoms have on these expectations when we see the impact of people being able to access their pension savings from age 55, potentially running down pension pots before they even retire. The state pension is £7,500 a year. This won’t be an adequate income for many.

“With the allure of a big cash injection proving to be hard to resist for some, hopefully these figures will be a useful prompt to get people thinking about how long their pension pots need to last and encourage them to consider the impact of withdrawals.

“Research we conducted last year showed that men underestimated their life expectancy by 5 years and women by 8 years*. In that context most are going to underestimate how much time they will spend in retirement and how much money they’ll need to get them through to the end of their lives. In light of that we expect these figures for ‘time spent in retirement’ will come as a surprise to many.

Please note that they are averages. With around one in ten people living more than 10 years longer than their life expectancy, budgeting for beyond life expectancy is necessary to be sure of being comfortable in late life.

“It’s vital that people seek guidance and/or advice on how to make sure they can get through to the end of their life in dignity.

Freedom and choice in pensions has made the decisions people now have to make far more complicated. Tools need to be made available to help people understand the impact of their decisions, particularly in relation to withdrawals, from age 55 and not just at the point of retirement. Fortunately these are emerging.”

|