By Michelle Bellwood, Principal and Senior Investment Consultant at Barnett Waddingham

Secondary markets have evolved into a crucial tool for investors looking to optimise portfolios, manage liquidity, and adjust exposure to different managers and vintage years. Initially dominated by private equity, secondary markets are rapidly expanding into other asset classes such as private credit, real estate and infrastructure, offering both sellers and buyers a versatile financial playground.

Increasing diversification of asset classes

While private equity remains the largest sector for secondary transactions, the landscape is rapidly evolving as other asset classes gain prominence. Private credit, real estate, and infrastructure are emerging as attractive options within the secondary market.

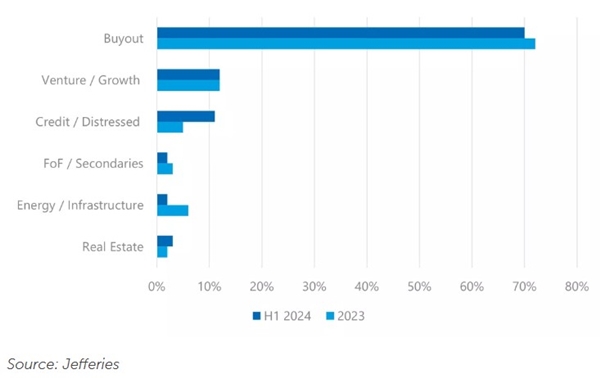

The graph below shows transaction volume by strategy (%)

The rise of these asset classes in the secondary space is creating a more dynamic and diverse market.

Previously, Limited Partner-led (LP) portfolios dominated by private equity with smaller allocations to credit or real estate were often acquired by a single buyer. Today, large LP-led transactions (those initiated by investors wishing to sell their holdings) are increasingly structured as ‘mosaic’ deals, where multiple buyers can pick and choose specific portions of the portfolio that align with their investment strategies.

Growing opportunities in private credit

Managers specialising in these asset classes are now launching dedicated secondary funds, providing investors with a broader array of investment opportunities.

In private credit, for instance, secondary buyers can acquire stakes in existing credit portfolios, benefiting from immediate income streams and avoiding the blind pool risk (i.e. whereby investors do not know the ultimate make-up of their portfolio at the point of investment) and lengthy capital deployment period typical of primary investments. We see greater value in a manager with credit underwriting experience evaluating these deals, rather than one relying on a more traditional private equity secondary approach.

We maintain a positive outlook on the private credit asset class. While discounts may be modest for top-tier investments, we believe that gaining access to these assets through secondaries offers an attractive way to build a portfolio of strong, income-generating investments.

Growing opportunities in real estate and infrastructure

Investors looking for exposure to real estate can acquire stakes in established portfolios with a more predictable income profile, bypassing the potential development or construction risk. Similarly, infrastructure secondaries are gaining traction as investors seek long-term, stable cash flows in essential sectors such as energy, transportation and utilities.

The strong performance and stability of the infrastructure sector, combined with tailwinds like digitalisation and decarbonisation, create a positive outlook. The secondary market, offering an alternative access route, is certainly worth considering for investors.

What has driven the expansion of secondary markets?

Secondary investments are no longer viewed as a last resort but have become a strategic tool for managing portfolios. An increasing number of sellers are entering the market, including those offering attractive, high-quality funds backed by strong sponsors. Several cyclical factors have also contributed to the growing prominence of secondary investments, outlined below:

Slow distributions and extended fund terms: In today’s macroeconomic environment - marked by slow distributions and extended fund terms within primary market assets - secondary markets provide a vital source of liquidity. Investors who do not want to endure longer investment horizons find secondary transactions particularly appealing.

Liquidity demand: Investors facing liquidity constraints or needing to rebalance their portfolios are increasingly turning to secondary markets, especially during times of market uncertainty. These motivated sellers contribute to the range of portfolios coming to market in the secondary space.

Continuation vehicles and general partner-led deals (GP): A key trend in secondary markets is the rise of GP-led transactions (i.e. those initiated by fund managers). Fund managers are increasingly using secondary deals to offer liquidity to existing investors or to extend a fund's life through continuation vehicles. These transactions allow GPs to retain high-performing assets while offering LPs the option to exit, and this trend is expanding beyond private equity into other asset classes.

The above factors impact all underlying private market asset classes, highlighting the opportunities that will be coming to market across the board.

Key benefits of secondary investments

Regardless of the underlying asset class, the benefits of secondary allocations remain the same, namely:

Day one uplift: Secondary buyers often acquire assets at a discount relative to their underlying value, allowing for immediate gains on the investment. However, it is important to ensure that value is not placed solely on the initial, potentially outdated uplift but also considers potential future cashflows.

Reduced J-curve effect: In traditional private market investments, the J-curve refers to the early period of negative returns as funds draw capital and build their portfolios. In contrast, secondary investments typically bypass this early stage, providing more immediate value.

Limited blind pool risk: Secondary market investors have access to more mature funds, which means they are investing in known companies, reducing the uncertainty that comes with committing capital to a blind pool of investments.

In evergreen private market vehicles (i.e. those with no fixed end date), secondaries often play a crucial role in providing liquidity.

By incorporating secondary transactions, the underlying portfolio gains exposure to companies typically late into or past the initial investment period, and potentially providing distributions in the immediate future. This approach ensures that newer capital can enter the fund without diluting the interests of early investors.

Next steps: a strategic investment approach

We expect private equity deals to continue dominating the secondary market, given their typical lengthy tenor, slow current distributions and strong upside potential relative to other assets.

The potential benefits of secondary market investments in private credit and real assets are slightly lower than private equity, given their inherently higher liquidity and lower return upside. However, we believe the secondary market can nevertheless serve as a valuable tool for investors, offering an alternative access route for those wishing to enhance the liquidity profile of their investments.

Our dedicated manager research team have extensively researched a range of funds investing both solely and partially in secondary market private assets (including multi-asset funds). We can provide you with detailed knowledge and advice to help you select the best fund for you.

Amy Taylor, Senior Investment Research Specialist, contributed significantly to this article.

|