-

Idea is a welcome development, particularly given current low bond yield conditions, though market conditions could change

-

Significant costs for buyers could affect the attractiveness of pricing offered to sellers, particularly for those looking to cash-in small annuities

-

Creation of standardised health underwriting, auction-style marketplace, robust audit trail to document seller’s reasons, and permitting existing annuity providers to voluntarily offer surrender terms to customers are all needed

In its response to the Government’s consultation, the firm highlighted several barriers to a functioning market. For buyers, setting an accurate, attractive and defensible price will prove challenging. The difficulties of estimating life expectancy, costs of the underwriting process and concerns over dispute resolution in the event of a seller’s premature death are all key reasons.

As a result, Hymans Robertson believes life insurers who manufacture annuities will be best placed to offer attractive trade-in terms. In addition, existing providers should be able to offer better terms than third party insurers as some duplication of costs will be removed. Pension funds are unlikely to compete on cost but could be attracted to this market if second hand annuities were bundled and securitised and offered higher yields than other investments.

The pricing difficulties, even for existing providers, are likely to lead to buyers offering more conservative prices however. For sellers, this will combine with other barriers. These include the complexity of the market, which could lead to the need for further advice and its associated costs. Sellers also face an extensive qualifying process as buyers assess their life expectancy.

Finally, while cashing-in is likely to appeal especially to retirees with small annuities, the underwriting cost is likely to result in less competitive pricing for this group in particular compared to holders of larger annuities.

Commenting, Douglas Anderson, partner at Hymans Robertson said:

“For both buyers and sellers, creating this market looks attractive on paper. An opportunity to free-up cash for retirees and access to long-term, matching assets for insurers and pension schemes. What looks good on paper doesn’t always translate to reality though – critical elements need careful design to ensure we make a cake with enough slices to go round.

“Sellers will naturally compare the money invested and payments received since the annuity started against the trade-in value. Under present market conditions this depreciation would be small if selling back to the original annuity provider, but would increase with a sale to others.”

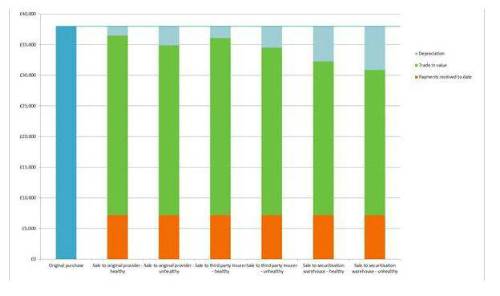

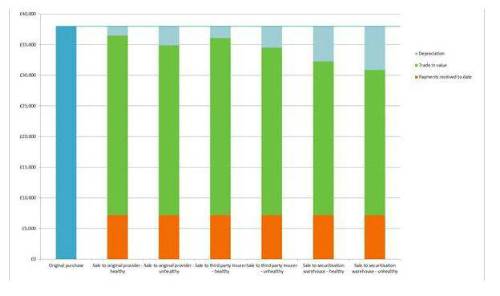

The chart below shows how prices may vary depending on the health of the individual and the buyer of the annuity stream.

Explaining the likely pricing, Douglas Anderson continued:

“A healthy 65 year old who spent £38,000 on an annuity in 2012 could get back around £36,000 if they cashed in today. .. That excludes tax and takes into account the payments already received through the annuity. Older pensioners who bought earlier could get back more, because of the larger fall in interest rates. In a less favourable interest rate environment however, the cost of depreciation could be much higher.

“Buyers’ ability to offer attractive prices will be constrained by the costs of underwriting, prudence for potential premature deaths, ongoing administration, and of course the need to make a profit. In the event of a seller’s premature death, buyers will also be forced to question the terms of the price they offered based on the information they gathered.

“Cashing in an annuity will still appeal to some retirees, but it will be a complex decision likely requiring significant thought and potentially advice. The last thing insurers want is another mis-selling scandal. That too could lead to conservative pricing.

Highlighting what needs to happen to make the market a success, Anderson continued:

“Making this market successful and safe will require five things. First, a standardised health underwriting process to give confidence to all buyers. Second, an open bidding process whereby all buyers can offer a price to sellers based on their assessment of the data provided.

“Third, a robust audit trail of the seller’s decision and reasons behind it. This suggests the potential for further advice behind the decision. Fourth, a major communication exercise by government, similar to the pension freedoms earlier this year. Finally, allowing existing annuity providers to voluntarily offer surrender terms to customers, which would likely improve pricing.”

Further information on data and assumptions can be found in our consultation response at www.hymans.co.uk |