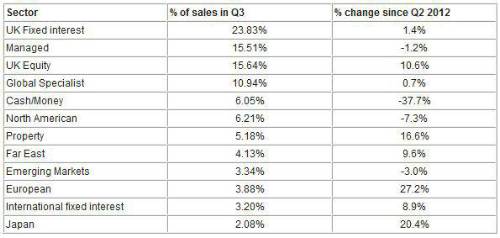

The Q3 sales figures from the Skandia fund platform, part of Old Mutual Wealth, show investor confidence starting to return.

Sales into cash have fallen by 38%, with investment going into riskier assets, including European Equity and Japan.

Sales into European Equities rose 27% over the quarter, and although overall sales in this area are still low, they have now overtaken emerging markets - which actually fell 3%. This surge in sales could be driven by their seemingly undervalued equity prices, and the renewed optimism in the area as a result of the recent European Central Bank announcement. It is likely that this area will continue to experience short-term volatility, but could prove to be profitable in the longer term.

Japan remains the sector with the lowest sales, but inflows have risen by 20% over the quarter. Interest in Japan seems to be concentrated to a few key funds, with over 60% of sales in this area going into just 3 funds that are well known and have offered good returns in the past.*

Property is up 17% over the quarter, with a bias towards UK property. Now that the speculators have left the market, property seems to be reverting back to more normal behaviour, making it more appealing for those looking for medium to long-term growth opportunities.

The UK fixed interest sector continues to dominate sales for the quarter, accounting for nearly 24% of total platform sales. Research by Skandia shows one in three UK financial advisers believe UK gilts are in bubble territory and will offer the worst returns over the next year **. Advisers have become sceptical due to the recent incredible performance of gilt funds; something which they believe is a reflection of sentiment rather than fundamentals, and cannot be sustained. Advisers may choose corporate bonds rather than gilts going forward; if that is the case this sector is likely to continue to be dominant.

Graham Bentley, Head of Proposition at Skandia comments:

"It is only a matter of time before there is a correction in the gilt market, and investors may be better served by a move from gilts into other asset classes. However, the real growth going forward is likely to come from equities rather than fixed interest stocks. Equities generally continue to be undervalued, but real gains can be made from choosing the right sector for investment. It might surprise some people but the FTSE 100 is up almost 20% in the last year, and the FTSE 250 nearly 30%***. Even European equities stand out as a potential opportunity as they are so undervalued, and the outlook for Europe is improving all the time."

|