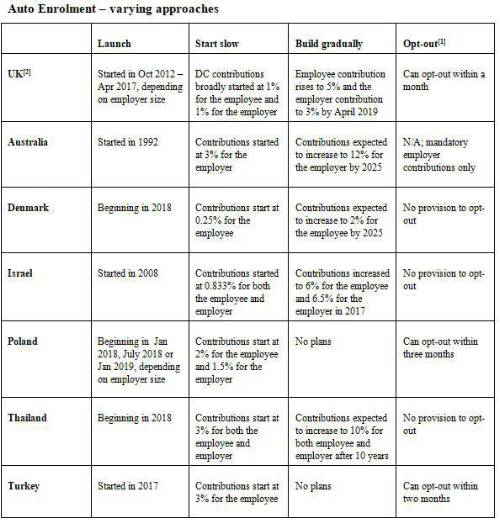

With the UK well into deployment of auto enrolment, many countries worldwide are now developing and implementing their own pension reforms. While there are similarities in approach, the most notable differences are in relation to required contribution levels and the split of the contribution between employee and employer. For example, when compared against the 8% ultimate contribution in the UK, Thailand requires much higher levels of contribution, opting for a contribution rate of 20% (split evenly between the employee and employer). Israel is another example where the mandated contribution is higher at 12.5% (of which the employer will pay 6.5%, and Australia, which started the auto enrolment journey in 1992, sets its own ultimate contribution rate at 12% financed purely by the employer.

Mark Sullivan, Head of International Benefits Consulting, Fidelity Benefits Consulting commented: “With global financial and social pressures continuing to grow, there is an expectation that many more countries will have to introduce pension reform as a critical step in addressing concern over the sustainability of fragile state pension systems. Denmark, Poland and Turkey have already started, or intend to start this process over the next 12 months, and other countries are expected to follow. The countries that have already developed or introduced their framework, however, must not be complacent. The question those countries need to ask is whether their auto enrolment scheme goes far enough?

“While some governments in Europe have chosen to encourage the right behaviours through a combination of state provided, minimum mandatory and tax incentives for supplemental provision, there is no guarantee that this approach is sustainable. Although in the UK for example, opt-out rates from auto enrolment schemes are lower than were expected, many savers are still not saving enough to maintain a comparable standard of living in retirement. Inertia and low initial levels of contribution mean more needs to be done in terms of encouraging, or mandating, higher saving rates.”

Sullivan added: “Whether the UK and Europe need to adopt a tougher stance in terms of level of contributions and opt-out requirements as Israel has done and as Thailand is about to, remains to be seen, but auto enrolment at existing contribution levels is not a sustainable solution. However, in the absence of further changes to mandatory contribution levels, financial education is absolutely critical to encourage people to save adequately and to continue to do so.”

|