Whether you’re a long way off retirement or already taking money from your pension plan, there are things you can do to help get the most out of your savings. Since it’s Valentine’s Day, now is the perfect time to give your pension some love.

The single biggest way to give your pension some attention is by topping up contributions. Standard Life analysis shows that increasing contributions by just 2% a month over the course of a career could lead to £108,000 more in retirement.

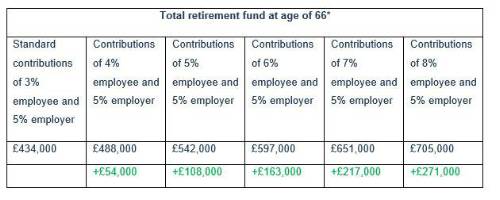

For example, someone that began working full-time with a salary of £25,000 per year and paid the standard monthly auto-enrolment contributions (3% employee, 5% employer) from age of 22, could amass a total retirement fund of £434,000 at the age of 66.

However, if they were to increase their monthly contributions by 2% (5% employee, 5% employer) from the age of 22, they could accumulate £542,000 by the age of 66 – £108,000 more than standard contributions might achieve. These figures aren’t adjusted for inflation. Making higher contributions could have an even bigger impact on a retirement pot – even a 1% increase could produce £54k of additional savings.

*assuming 3.50% salary growth per year, and 5% a year investment growth. Figures are not reduced to take effect of inflation. Annual Management Charge of 1% assumed. The figures are an illustration and are not guaranteed. Earning limits not applied.

Dean Butler, Managing Director for Customer at Standard Life said: “This Valentine’s Day, if your finances and circumstances allow, show your future self some love by boosting your pension contributions. It’s amazing to see how a relatively small increase in contributions can significantly boost the pension you retire on by tens of thousands of pounds. While pension payments may not be the top priority when you begin your career, or when finances are squeezed, it will pay off in future.”

Dean Butler Standard Life shares some simple tips on how else you can give your pensions some love this Valentine’s Day:

1. Access advice or guidance

Many people feel unable to seek financial advice as things stand, and we’d like to see greater access to affordable advice. If you are able to, Unbiased is a good place to start. It’s important to understand and be comfortable with the cost of advice compared to any charges you’re currently paying on your savings for retirement. There are also a number of free guidance services available including the Government’s Pension Wise service.

2. Brush up on your pension knowledge

The more you know about pensions, the easier it can be for you to make informed choices about your own pension plan. There are plenty of free online resources to help you get to grips. MoneyHelper, backed by the government, provides clear guidance on your money and pension choices, explaining what you need to do and how you can do it.

3. Download an app or register for online servicing

Keeping an eye on your pension savings doesn’t have to mean setting aside lots of time or sitting down with a stack of documents. Using apps or online servicing can be a quick, easy way to look at your pension savings – and you can do this on the go. There are often other things you can do online or through apps, such as making pension payments or updating your details.

4. Check your beneficiary information is up to date

Your pension savings aren’t normally covered by your will, so your pension provider ultimately decides who receives them when you die. However, depending on the type of pension plan you have, you can usually name the people you want your money to go to. These are known as your beneficiaries. Your pension provider will take your wishes into account, but they cannot be bound by them.

If you’ve already nominated your beneficiaries, you should review them regularly and update this information if your wishes change. For example, someone may want to change their beneficiaries after remarrying or having children. Keeping this information up to date can help make sure your money goes to the people you want it to. You might need to ask your pension provider for a beneficiary nomination form. Or you may be able to name and update beneficiaries online.

5. Check on your investments

It’s important to look at where the money in your pension plan is invested – whether you’ve chosen those investments yourself or someone else has done the work for you. If you’re a long way from retirement, you might be happy to take more risks with your pension investments as you won’t be accessing your savings for a while. But if you’re nearing retirement or taking money from your pension plan already, you may want to take less risk. Whatever your situation, it’s important you feel comfortable with your investments and that they match up with your goals.

6. Check you’re getting everything on offer from your employer

If you’re saving for retirement, you could check that you’re making the most of your pension plan’s benefits. For example, if you’re over the age of 22 but under State Pension age, you’re likely to have been automatically enrolled in a workplace pension scheme. In this case, your employer normally needs to pay in a minimum of 3% of your earnings, while your minimum payment is usually 5%. Some employers are willing to pay in more than the 3% minimum, and some might match your payments up to a certain amount – so if you put in more, they will as well. It’s worth checking with your employer to see what’s possible as this could help increase the money saved into your pension plan.

7. Make sure your personal information is correct

If your contact details are out of date, your pension provider might not be able to get in touch with you, and you could lose track of your pension plan – meaning you spend time tracing your pensions or even miss out on money.

You might consider combining your pensions to keep track of them, which involves bringing multiple pension pots together.

However, it’s important to be aware that transferring may not be right for everyone, and you should seek advice if you are considering this option.

|