There is variation in funding levels according to size of scheme.

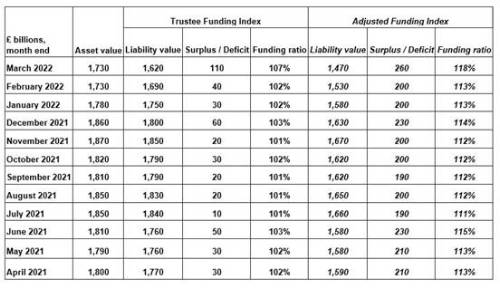

PwC’s Adjusted Funding Index now shows a £260bn surplus - this incorporates strategic changes available for most pension funds, including a move away from lower-yielding gilt investments to higher-return, income-generating assets, and a different approach to pre-funding potential life expectancy changes.

Raj Mody, global head of pensions at PwC, said: “Pension scheme funding levels have shown resilience, improving again this month in aggregate. However, when looked at on a scheme by scheme basis, a different picture emerges. We expect about 3,000 schemes are in a surplus position, leaving around 2,000 schemes in deficit. There is some pattern according to scheme size - the smallest and very largest schemes find themselves in surplus. This leaves a strained segment in the middle typically in deficit, and those schemes will still need a plan to repair those deficits.”

Laura Treece, pensions actuary at PwC, added: “Strategies for pension schemes which still have a deficit will be very different to those in surplus. They may need to rely on the sponsor’s ability to pay money into the scheme to fund the deficit, perhaps for several more years. Even if no more cash is required but it’s a waiting game to become better funded over time, trustees want to know they can rely on a resilient sponsor business. Laura Treece, pensions actuary at PwC, added: “Strategies for pension schemes which still have a deficit will be very different to those in surplus. They may need to rely on the sponsor’s ability to pay money into the scheme to fund the deficit, perhaps for several more years. Even if no more cash is required but it’s a waiting game to become better funded over time, trustees want to know they can rely on a resilient sponsor business.

“Trustees and sponsors of schemes in surplus will have more options available, and sooner than they originally thought possible, in terms of defining and reaching their ‘end-game’. In the meantime, they will want to manage any surplus buffer and their overall strategy with the same diligence they applied when in deficit. It’s all too easy to leak value from inefficiencies in investment, risk and governance decisions when in surplus.

“No matter whether a scheme is in surplus or deficit, there are several areas to manage carefully. This includes the scheme’s ability to pay cashflows as they fall due, particularly given current volatility in asset prices and yields.”

The Pension Trustee Funding Index and Adjusted Funding Index figures are as follows:

|