By Rosie Fantom, FIA CERA, Principal and Bulk Annuity Consultant, Barnett Waddigham

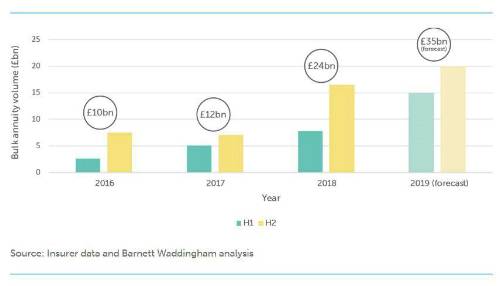

Recognising that prediction is always a dangerous game, our expectation is that 2019 will be the biggest year to date in the bulk annuity market with around £35bn written. Unlike 2018, insurers are expected to focus solely on transactions with pension schemes, rather than also competing for a large block of annuities sold by another insurer. For example, along the lines of the £12bn transaction between Prudential and Rothesay Life in 2018.

How schemes need to engage with insurers

This busy market buoyed by improving pension scheme finances and sponsors’ desire to rid themselves of the significant risks associated with these legacy DB schemes, insurers are able to be selective about where they chose to participate and ultimately focus on particular opportunities.

There are certainly signs of resource challenges as a result of the step change in activity. All schemes need to undertake detailed preparations to secure insurers’ engagement, but the bar is certainly higher for those at the smaller end of the market. Reinsurers quotation capacity is also being tested by insurers seeking to get tailored pricing for passing on some of the longevity risks associated with bulk annuity and longevity business. In the face of heightened demand, there is the potential for insurer pricing to increase, but this has not been the case to date with transactions continuing to offer value to schemes looking to capture opportunities in this market.

We are anticipating that some larger cases that had originally considered a 2019 transaction will stretch their timings into 2020 as insurers draw closer to achieving their volume targets. There may be some opportunities for the smaller and medium sized cases to get a greater slice of insurers’ attention as the year marches on, where providers look to top up their sales volumes to reach their targets and demonstrate that they are open to schemes of all shapes and sizes.

Regulatory disruption

There is potential for some bumps in the road from regulatory activity, which could disrupt the market. Whilst it is reassuring to see the Prudential Regulation Authority (PRA) is monitoring insurers, their 2019/20 Business Plan does suggest that there could be some additional focus on bulk annuity firms’ asset holdings. Its plan focuses on life insurers’ holdings in illiquid assets, with some bulk annuity providers holding more than half of their assets in these classes. The additional returns largely associated with illiquidity premia offered by these investments support insurers’ ability to offer compelling bulk annuity pricing. If the PRA looks to flex its muscles in this area, we may see prices hardening, at least for a time whilst insurers address its concerns. Of a particular note, will be its actions in response to its latest equity release mortgage consultation expected later in the year, with implementation from 31 December 2019.

In a recent speech to the Association of British Insurers, David Rule from the PRA explained how they were monitoring insurers’ capital requirements. These can be driven by insurers’ internal models or by the Standard Formula. David noted that they were looking to see if capital requirements implied by firms’ internal models were falling relative to that required under the Standard Formula. Bulk annuity writers typically rely on internal models at least to some degree. He also acknowledged that there can be good reasons for differences in the two approaches. However, there was no mistake in the underlying messaging: the PRA is watching and is prepared to act. With the recent announcement that Rule is to undertake a two year secondment with the Financial Reporting Council, it will be interesting to see if this is an area of focus for his successor.

Given the inherent demand from pension schemes implementing their endgame strategies, we expect the bulk annuity market to continue to grow. Whilst the current levels of demand present some challenges and activity from the PRA may create some headwinds, this market has previously proved its resilience and ability to innovate. We expect schemes will continue to find attractive opportunities in this market.

|