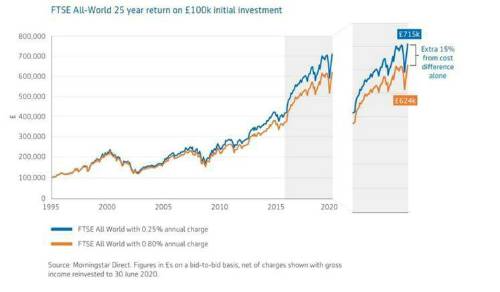

Fund charges can have a significant impact on the eventual payout for investors. For example, over 25 years, a £100,000 investment in the FTSE All-World Index with a charge of 0.25% would have returned over £90,000 more than the same investment with a charge of 0.80%.

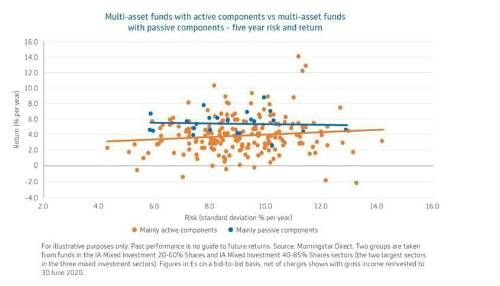

The analysis also showed that multi-asset funds with passive components have tended to provide better risk-adjusted returns than those with active components. Aegon analysis explored the risk and return profile of funds from the two largest Investment Association (IA) Mixed Investment sectors and compared those using mainly passive components to those using mainly active ones over five years. Figures show that those using passive components generally delivered better returns for the level of risk taken.

Richard Whitehall, Head of Portfolio Management at Aegon comments: “Over half of UK investors choose not to invest at all, preferring to keep their money in a bank account. For many people the complexity of funds and a misunderstanding around fees may be a contributing factor. We believe that a product should be as simple as possible without compromising functionality. Complexity, which tends to come with higher cost, should only be added where value can be demonstrated. Ultimately, if an investor can’t understand a product, it will impact their experience and outcome.

“As such, there is a benefit in offering investment strategies that can be easily understood by a client. The FCA is currently looking into the consumer investments market and we support introducing steps that make it easier for investors to make informed decisions so that they understand the types of products available to suit their needs, the costs involved and the regulatory protection available.”

Aegon recently launched a range of Risk-Managed Portfolios which use passive investments and avoid costly alternatives but employ active asset allocation aiding returns – all for a fixed OCF of 0.25%.

There is no guarantee fund objectives will be met. The value of investments may go down as well as up and investors may get back less than they invest. Although there is no fixed term, customers must be prepared to invest for the medium to long term of at least five years, ideally longer.

|