With MPs this week debating an amendment to the Pension Schemes Bill that would see Pension Wise guidance sessions automatically booked for pension savers, retirement income specialist Just Group said it supported a more active approach to dramatically increase the use of guidance by pension savers to help them make good choices and beat scams.

“Passive measures such as the signposting in ‘wake-up’ packs will at best only deliver marginal gains,” said Stephen Lowe, group communications director at Just Group. “Guidance is a key consumer protection against poor decisions and scams and it is important to put in place measures that ensure the majority, not just a minority, receive that support.”

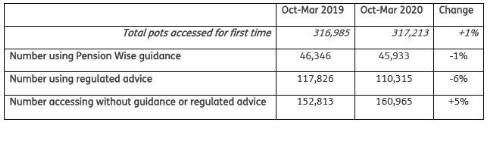

He said that analysis of FCA retirement income market data figures shows that both the number and proportion of people using the free, impartial and independent guidance service, Pension Wise, or regulated advice when taking pension cash has actually fallen since the ‘wake-up’ pack overhaul last November. In the six months between October 2019 and March 2020 the numbers using Pension Wise fell by 1% to 45,933 compared to October 2018 to March 2019, despite a 1% rise in the number accessing pensions for the first time.

Providers had to have introduced the new packs by November 1st 2019, although some started earlier.

In contrast the number taking pension cash without either guidance or regulated advice rose by 5% to 160,965 which is more than half (51%) of all those accessing pensions for the first time. Pension savers were also less likely than a year earlier to shop around with around six in 10 (59%) buying annuities or drawdown plans from their current provider.

The FCA made the changes to address criticisms that the ‘wake-up’ packs – officially called open market options statements – were ineffective because they were too long, complex, jargon-filled and could be accompanied by provider promotions. Since November, the pre-retirement communications must be sent when the pension saver reaches age 50 and at regular intervals. It includes a single A4 page of prescribed content, a so called ‘Pension Passport’, covering key details about the client and their pension, a ‘clear and prominent’ statement about the availability of free and impartial guidance, and a recommendation to take either guidance or regulated advice.

“Consumer-friendly packs are a step in the right direction but need to be reinforced with stronger measures such as the amendment this week proposed by Stephen Timms MP to automatically schedule Pension Wise appointments,” said Stephen Lowe. “A similar idea for default guidance was proposed by MPs on the influential Work & Pensions Committee in 2017. The Department for Work and Pensions has ignored their recommendations and instead proposed what amounts to the very gentlest of ‘nudges’.

“If the FCA follows this weak lead from the DWP, many thousands of savers are likely to miss out on vital, impartial guidance to help them avoid the known pensions access pitfalls. “Government and regulators need to be more ambitious. Our own research shows that only one in 25 pension savers (4%) would opt out of free impartial pension guidance if it were automatically booked for them.

“We think it is the best way to ensure guidance reaches those who have the most to lose from not receiving help and making uninformed, poor or hasty decisions.”

|