Analysis of the Department for Work & Pension’s Pensioner Income Series1 by Broadstone, the leading independent pensions, investment, and employee benefits consultancy, finds a growing income gap between the poorest and richest pensioners.

Single pensioner incomes in the bottom quintile grew by a mere 2% before housing costs between 2010/11-2011/12 and 2020/21-2022/23, recording an average increase of just £208 a year. In contrast, those in the top quintile saw income growth over the same period of 9%, equivalent to £2,496 every year – an additional £2,288 than those with the lowest incomes.

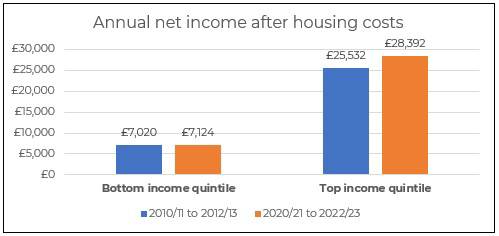

The contrast was even more marked after housing costs, with single pensioners in the bottom income quintile seeing their income increase by just £1 a week over the past decade. Those in the top quintile recorded income growth of £55 a week, or £2,860 a year.

Meanwhile, single pensioners in the bottom quintile saw 88% of their gross income before housing costs provided for by the State Pension and benefits – a very slight increase from 87% a decade earlier. It suggests they entered retirement with little in the way of pension or other savings.

In contrast, single pensioners in the top quintile saw the State Pension and benefits account for under a third of the income of those in the top quintile (31%), where a significant proportion was made by occupational pension income (34%), personal pension income (32%) and earnings income (16%).

Damon Hopkins, Head of DC Workplace Savings at Broadstone, said: “These figures show that the gap between the ‘haves’ and ‘have-nots’ in retirement has widened sharply.

“Single pensioners already face significant income pressures, especially as they must pay bills via a single income, but they have barely seen any increase in their income over the past ten years.

“Despite triple lock increases to the State Pension and increases to other benefits, it is clear that more people are entering retirement with inadequate savings leaving them reliant on these sources of income.

“Our message to those struggling would be to seek help from sources like Citizens Advice, Pension Wise or their local council as there is a wide range of support to help those in difficulty.

“The data also demonstrates the urgent need for pension savers to consider the standard of living in retirement that their current contribution rates are likely to achieve. The average single pensioner’s income is under £17,000 after housing costs, around half the £31,300 annual income the PLSA indicate is needed for a moderate living standard.”

|