Analysis from retirement specialist Just Group uncovers the extra income pensioners need – on top of the current full new State Pension – to reach a Minimum Income Standard in retirement.

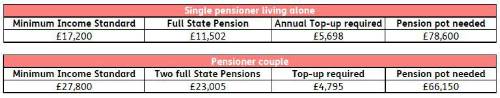

A single pensioner receiving the full State Pension of £11,502 a year would still need an additional £5,698 income from pensions, savings and investments to reach the Joseph Rowntree Foundation Minimum Income Standard of £17,200 a year.

To purchase a Guaranteed Income for Life delivering £5,698 a year of income, a single person would need a pension pot equivalent to £78,600 by the time they reached State Pension Age at aged 66.

The picture is healthier for pensioner couples. Due to combined State Pensions totalling £23,005 a year and being able to share household costs, they would require an additional £4,975 income to bridge the gap to the Minimum Income Standard of £27,800.

That would require a combined pension fund of about £66,150. It’s important to note that when one partner dies the surviving partner would lose one State Pension income, so thought would have to be given to providing an adequate income for the surviving partner.

Stephen Lowe, group communications director at retirement specialist Just Group, said: “The Joseph Rowntree Foundation’s Minimum Income Standards are a helpful guide for the income pensioners are likely to need to live in dignity during retirement.

“Even assuming pensioners are receiving the full State Pension – which we know many are not – they will still need to find thousands of pounds of year of extra income to bridge the gap to the Minimum Income Standard.

“It demonstrates the importance of building up additional sources of income throughout a working career, whether that is through the pension system, using property as a reservoir of wealth or accumulating additional savings and investments.

“The good news is that for many people the amounts needed to supplement the State Pension are achievable but it should be noted that this is only enough for ‘a dignified socially acceptable standard of living.’ Many people will have other ambitions and they should consider whether their current savings are on track to meet those expectations.

“There are a range of services that pension savers can look towards for help and guidance on whether they are on track for the retirement they want. The government’s free, independent and impartial guidance services, Pension Wise and MoneyHelper, are good places to start.”

|