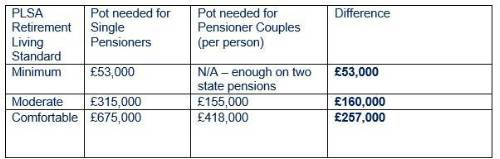

New analysis by Standard Life, part of Phoenix Group, highlights the additional savings that single people need to build up for retirement, compared to pensioner couples who are able to share costs. The analysis used the MoneyHelper annuity tool to reveal the differences in pension pots needed to secure the PLSA’s ‘minimum’, ‘moderate’ and ‘comfortable’ standard of living in retirement.

Single retirees who want to achieve a minimum living standard, which includes enough for the basics and one week’s holiday in the UK a year but no car, require an annual income of £12,800, according to the PLSA. Assuming a full state pension (£10,600 a year) is received, a retiree needs an income of £2,300 before tax each year to maintain this standard of living. In order to buy an RPI linked annuity - which is a guaranteed income for life - they would need to have amassed around £53,000 in retirement savings at current rates. The Living Standards highlight that pensioner couples need an annual income of £19,900 to reach the same standard of living, however this would be covered by two full state pensions meaning they would not need to have accumulated any additional savings to cover a basic retirement lifestyle.

For a moderate retirement standard of living, which allows for a car and one two-week foreign holiday a year, the PLSA calculates single pensioners need an income of £23,300 per year. Assuming a full state pension is received, they would need an annuity which provides £14,900 a year, after taking account of income tax. To achieve this they would need to save around £315,000. Pensioner couples, meanwhile, need an annual income of £34,000, which they could get if they also amassed £310,000 in their joint pension pot, meaning they would need to save £155,000 each – around half the amount of a single pensioner.

For a comfortable living standard in retirement, which allows for a 3 week foreign holiday, a full kitchen and bathroom replacement every 10-15 years and a £1,500 a year clothing and footwear budget, single pensioners would currently need to accumulate a pot of around £675,000, while pensioner couples would need £835,000 between them, or around £418,000 each – meaning a single pensioner would need to save an additional £257,000 to achieve the same lifestyle as a couple.

Retirement savings needed for single pensioners and pensioner couples to secure an annuity – guaranteeing an income for life:

* Figures assume retirement at the age of 66, single life annuity, no guarantee, paid monthly in arrears, linked to RPI, non-smoker with no underlying health conditions. Account for tax free income up to Personal Allowance and then income taxed at 20%.

Dean Butler, Managing Director for Retail Direct at Standard Life said: “Whether single by choice or by circumstance, single people have to front a whole host of expenses on their own – from mortgage or rent payments, utility bills and council tax, to broadband, holidays and TV subscriptions – and unfortunately these aren’t automatically half the amount that couples pay. It’s a similar situation when it comes to pension savings too. While couples can pool their finances for retirement, single people need to support themselves independently. As our analysis shows, single pensioners need to amass a bigger pension pot to achieve the same standard of living as pensioner couples.

“It’s therefore particularly important that single people start thinking about their retirement finances as early as possible. It’s also a fact of life that not all relationships last, and there’s a chance couples will divorce – in this scenario, awareness of these figures are a good place to start when thinking about how to approach Pension sharing and the possibility of a single retirement. Knowing the sort of lifestyle you want in retirement will help you plan, and the PLSA Retirement Living Standards tool outlines the savings target that you might need to get there. Saving into a pension from an early age will give your money as much time as possible to grow and benefit from possible compound investment growth, while boosting your pension contributions is also a great way to build up savings. Consider making top ups to the amount you regularly pay into your pension if you get a pay rise for example, or make a one-off contribution following a bonus. Clearly, it’s a difficult economic environment at the moment, but your future self will thank you for taking any opportunity to put money away for retirement.”

|