The Pensions Regulator and UK Government are on a path to lock down defined benefit schemes into a low dependent state. This means reaching a position where assets and liabilities are matched and the investment strategy is low risk with future reliance on the employer not anticipated.

To help trustees and employers alike contextualise the funding position on a low dependent state, Broadstone - a leading independent pensions consultancy - is pleased to announce the launch of the Sirius Index. The Index will track the progression of pension schemes to low-dependent or ‘self-sufficient’ status.

By mapping the movement towards this position across its wide book of clients, covering all areas of the market, Broadstone will provide novel and informed insight for the discussion on the success or otherwise of various strategies to achieve the low dependence position.

To do this in a way that may be more relatable to trustees and employers the BSI creates a number of sample schemes that are adopting alternate strategies and monitors their journeys to self-sufficiency, publishing findings on a monthly basis.

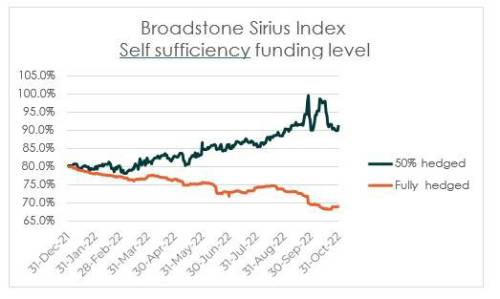

For our inaugural release, we have looked at the year to 31 October 2022 which represents an unprecedented year for the movement of long-term interest rates and this has thrown out some surprising results.

BSI shows that while the present values of liabilities have reduced, the loss of value in hedged strategies plus the underperformance of assets over the year has reduced the funding ratio from 80% at the beginning of the year to a much lower 69% as at 31 October.

For lesser hedged schemes, for example one that has hedged 50% of their liabilities, they may have had a bumpier ride over the year so far but as assets fell less than liabilities their position will have improved to 91% (from the same 80% funded starting point).

Nigel Jones, Head of Consulting & Actuarial, commented: “We are pleased to launch the Broadstone Sirius Index (BSI) which brings a unique perspective on the benefits of hedging or otherwise in the journey schemes are on to reduce risk and reach low dependency. Low dependency is an important goal that allows trustees and employers to push on towards buy-out and benefit security for all their members. Our evidence base is already highlighting the different experiences of varying strategies and the decisions trustees make at this point will be crucial to their path over the next 5 years and beyond.

We look forward to future releases of our monthly tracker and are sure it will be a useful part of the discussion”.

|