Overall, the Buyout Index continues to show near record levels of funding with a surplus recorded this month of £215bn. However, the slight fall in the average estimate of the cost to schemes to ‘buyout’ their pension promises highlights the increased competitiveness of the buyout market, especially for smaller DB pension schemes.

Meanwhile PwC’s Low Reliance Index has had a record month with a surplus of £365bn. This index assumes schemes invest in low-risk, income-generating assets like bonds, meaning they are unlikely to call on the sponsor for further funding.

John Dunn, head of pensions funding and transformation at PwC, said: “Our analysis continues to highlight that the UK’s defined benefit schemes remain stable and many continue to explore the possibility of transferring their liabilities to an insurer. But, with such high demand and record deal volumes over the first half of this year, smaller schemes need to ensure that they can still tap into favourable insurer pricing.

“As we approach the end of the year, some insurers who have annual capital allocation targets will have used up most of their capital, whereas others who might have lost out in competitive processes may still have capital that they want to allocate before the year is out. This creates transient pockets of capacity for well prepared schemes to take advantage of. However, this capacity and appetite is changing rapidly as insurers win or lose deals. Schemes that stay close to the market will know where each insurer’s sweet spots are, and can tailor their approach based on this to optimise their pricing.”

Dweenisha Caleechurn, director in PwC’s risk transfer team, added: “The key factor that’s driving the buyout approach and pricing is scheme size. We’re seeing a huge spread of pricing from insurers in the market - in fact, there could be up to a 10% difference between market leading pricing for larger schemes and average pricing for schemes at the smaller end of the spectrum.

We’re also seeing significant variations in quotations for individual schemes - there’s not one single price out there, so using the right approach to ensure they get the best price is key.

”Insurers are being more selective, but that doesn’t mean there aren’t still opportunities for small schemes - they might just need to be accessed in a different way. Sponsors and trustees looking to transact with smaller schemes will likely find that being as flexible as possible or even working exclusively with one insurer will help them get the deal done.”

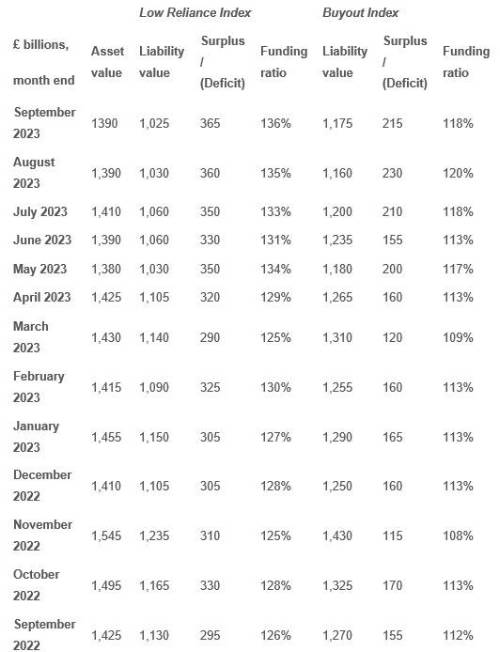

The PwC Low Reliance Index and PwC Buyout Index figures are as follows:

|