They have highlighted this stark difference in costs as one of the key considerations for trustees and sponsors, when thinking about running on the scheme instead of undertaking buy-out with an insurer. It believes, therefore, that trustees and sponsors of schemes smaller than £250m are unlikely to run on for purely economic reasons. The analysis has been published in Hymans Robertson’s Excellence in Endgames insights hub, launched last month to help schemes find their way through the maze of endgames options.

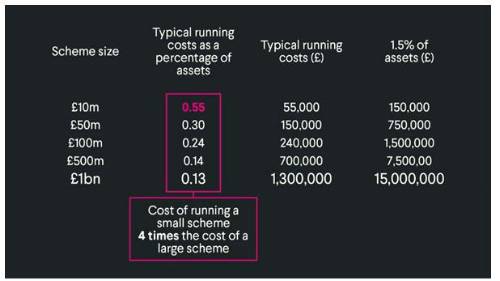

Commenting on the costs for small schemes, Laura McLaren, Head of DB Scheme Actuary Services, said:“Running on beyond buy-out funding is likely to be expensive for small schemes. TPR’s 2014 research found that the mean cost of running a small DB scheme was £1,054 per member, compared with £505 for a medium scheme and £281 for a large scheme. Based on these numbers, our modelling suggests that for small schemes annual expenses are 0.55% of scheme assets, compared with 0.13% for large schemes.

“The practical costs and challenges of managing a scheme for another 20 years tend to be amplified for small schemes. Even if a trustee or employer considers the cost of running on to provide good value, whether it’s the right choice depends on objectives and beliefs – and whether they align.

“Schemes also need to be clear about the costs and benefits of buying out with an insurer. Small schemes get similar longevity pricing to large schemes.

“When choosing between buying out and running on, trustees and sponsors should also consider the effect on members. Moving to an insurer frees the trustees of administering benefits, but it also takes away the control they have over the member experience.

“By keeping scheme surplus rather than passing on this value to an insurer, trustees retain control over where the money is invested. Surplus won’t emerge overnight, and small schemes have a smaller asset base with which to generate investment returns than large schemes. So trustees and sponsors need to take a long-term view, and decide how any value would be shared.”

Hymans Robertson’s analysis can be read in the article To run on or buy out? here.

|