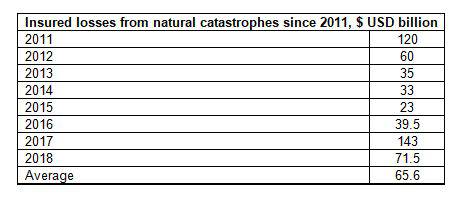

The average is driven upwards by peak annual losses of $120 billion in 2011 and $143 billion in 2017. In contrast to these previous peak years, where one or two natural disasters contributed a large percentage of the total insured loss, no such major event or events account for a large proportion of the 2018 losses. Instead, the total arises from a series of smaller and medium-sized loss events.

*Willis Re estimates, presented in USD at 1 December exchange rates for the year reported

The largest single insured loss was the Camp Fire, which will cost re/insurers between $6.0 and $10.75 billion, pushing the likely combined losses from the Carr, Mendocino, Camp, and Woolsey wildfires to about $15-17 billion. The insured loss range for Hurricane Michael is $6.0 to $10.0 billion; Typhoon Jebi in Japan delivered an estimate of $8.5 billion of insured losses. The largest European loss was winter storm Friederike, with insured losses of about $2.0 billion. No single major insured loss from natural disasters occurred in Latin-America or the Caribbean.

Karl Jones, Managing Director and Head of International Catastrophe Analytics at Willis Re, said 2018 was an unusual year. “The industry experienced a large number of mid-sized natural catastrophes. Three events – the Camp Fire, Typhoon Jebi, and Hurricane Michael – have all reached at least the high single digit billions in insured losses, but only the Camp Fire seems likely to exceed the level of $10 billion. However, a large number of smaller, billion-dollar losses, principally storms, has added up to make 2018 a costly catastrophe year. With the exception of the major California wildfires, these losses are well within modelled expectations.”

Vaughn Jensen, Executive Vice President and Head of North America Catastrophe Analytics at Willis Re, said: “The re/insurance industry has now absorbed more than $200 billion worth of natural catastrophe losses over a two-year period. It has been a significant test for both traditional and ILS capacity but overall the sector’s capitalisation remains strong. The distribution of smaller catastrophes in 2018 has given retrocessionaires and excess of loss reinsurers some breathing spaces, with the clear exception of aggregate covers as well as accounts with a concentration of exposure in California. The frequency of catastrophe losses over the last two years continues to result in many primary insurers rethinking their strategy around retention levels. Several sustained storms may also lead to reconsideration of hours clauses by cedants and reinsurers. On the back of this unusual catastrophe experience, we expect to see further reinsurance program adjustments as the year progresses.”

View the complete report here.

|