The number of households with a connected home device increased by 5% from 71% in October 2018 to 76% in May 2019 – which is more than the total number of households in Birmingham

The average spend on smart home devices is £836 per household

Insurers will have to respond by adapting their policies to capture smart home devices

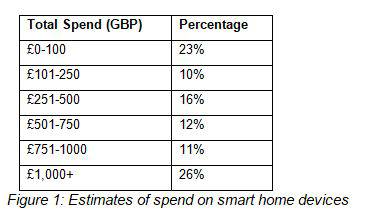

This is equivalent to an extra 1.36 million households2 purchasing a smart home device in the last eight months – more than the total number of households in Birmingham3. The average spend on smart home devices is £836 per household, with over quarter (26%) of households with a connected home device spending over £1,000.

Meanwhile, the average household has four smart home devices, including smartphones, which is more than the average household size of 2.4 people per home4. This number is likely to grow in the coming months and years with the continued development and popularity of smart technology.

Smart home revolution shows no signs of slowing

The exponential growth in the popularity of connected home devices shows no signs of slowing in the next 12 months. Over the course of the next year, one in five (19%) households are considering purchasing a smart home hub, such as an Amazon Echo or Google Home device.

A further one in five (19%) households are considering buying a smart surveillance camera, while 17% are weighing up purchasing a smart doorbell in an effort to boost security and awareness of activity on their premises.

Adam Powell, Co-Founder and Chief Operating Officer of Policy Expert, commented: “The smart home revolution is taking the nation by storm and is set to continue for the foreseeable future. The industry is beginning to understand that smart home devices, such as leak detectors and advanced smoke alarms, benefit both consumers and insurers. These devices can detect faults and security risks early, reducing the likelihood of policyholders making a claim or reducing the cost of a claim by providing an early warning.

“While most households are being retrofitted with smart home devices, houses of the future will likely come with them built in. Insurers will have to respond by adapting their policies to capture smart home devices. For example, this means ensuring that a customer is covered for theft if the burglar has gained entry to their home by hacking a smart door lock.

We are currently working on investigating the usability of voice enabled quotations through devices such as Amazon Alexa, whereby customers gain a quote after a short yet specific question set. It would rely on data enrichment and various factors, however it is not unreachable and supports our ethos to deliver our customer first-experience.”

|