The nationwide survey of companies employing between 50 and 300 staff – equivalent to around 34,000 businesses with an annual turnover of £541 billion and employing 3.3 million people – found 63% of bosses worry about a protection gap. Executives at larger SMEs employing between 200 and 300 are the most likely to worry about the protection gap – 71% said they were concerned.

MetLife’s research identified growing recognition of the value of benefits such as Group Life and Group Income Protection with 69% of SME senior managers believing they have a duty to provide benefits beyond pensions.

However around one in 10 – the equivalent of 34,000 businesses employing more than 300,000 people across the UK – say that they are unable to provide benefits beyond workplace pensions. Lack of budget is the biggest reason for not providing benefits beyond pensions followed by not believing their company is big enough.

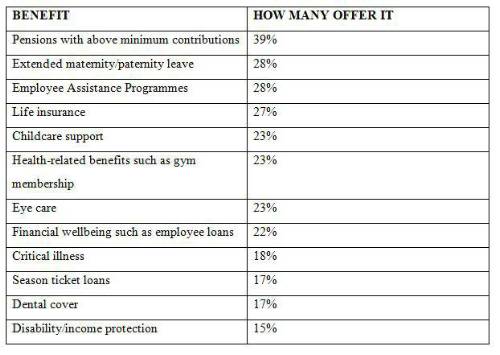

Most smaller firms however provide benefits. Employees are most likely to receive employer pension contributions higher than the statutory minimum with 39% of companies offering them while 28% provide Employee Assistance Programmes such as access to counselling.

Adrian Matthews, Employee Benefits Director, MetLife UK said: “SMEs are very much focused on retaining and recruiting staff and recognise the significant role that benefits in addition to salaries can play. It is interesting they believe they have a duty to offer staff more.

“The issue of the protection gap between SME staff and employees at larger corporates is however a concern for substantial numbers of senior managers who see the life insurance and income protection that major employers offer and wonder how they can compete.

“Budget is clearly a perceived issue for SMEs but in reality the costs are much more affordable than they think. Group Life can cost as little as 0.3% of payroll and Group Income Protection 0.5%.”

The table below shows the benefits that are provided at SMEs.

|